https://t.co/szdvZ2UYNf pic.twitter.com/vUrGt5urBQ

— Justa Puppet (@Anewhomestar) April 10, 2024

https://t.co/szdvZ2UYNf pic.twitter.com/vUrGt5urBQ

— Justa Puppet (@Anewhomestar) April 10, 2024

Translation: "The establishment needs another scapegoat to hide their deliberate actions to destroy the US economy "

"China China China" to be uploaded to NPCs on the next OTA update.

— Ryan Tyre 🇺🇸 (@ryantyre) April 8, 2024

The US Fed may kill the Biden presidency

It is no secret that one of President Biden’s key weaknesses in the upcoming presidential election is the economy. A USA TODAY/Suffolk University poll in March put Trump at 40pc, just ahead of Biden on 38pc. The same poll showed many Americans remain undecided; among those surveyed inflation and the economy were listed as the most important issues determining their vote.

As such, a core problem for Biden is the recent price rises and resultant cost of living crisis. In the past few months, political strategists have marvelled at the fact that the economy under Biden was growing (at 3.2pc in the fourth quarter of 2024) but polling on Biden’s performance on the economy was dismal.

A recent paper led by former treasury of the secretary Larry Summers has helped clear up the discrepancy. Summers and his co-authors show that if we adjust American inflation data to consider changes in methodology that have taken place over the past few decades, we see inflation not peaking at 9pc, as the official data indicates, but rather at 18pc. The paper also suggests that inflation measured in line with historical norms would have been 8pc at the end of 2023, not the 3pc shown in the official statistics.

This explains why the average American voter is angry at Biden about the economy: prices are still rising at a rapid clip and living standards have been substantially eroded under his administration. This puts the Federal Reserve in a very unusual position this electoral cycle, because what the central bank does in the coming months could have a huge impact on the outcome of the election.

Remember?

Today:

Proof eco-extremists don’t want to fix the problem, they want to tear down society.

This week, Harvard University has shut down a Bill Gates-funded geoengineering experiment. The controversial Stratospheric Controlled Perturbation Experiment, or SCoPEx, run by professors David Keith and Frank Keutsch, aimed to study the potential future implementation of geoengineering by crop dusting sulphuric acid into our stratosphere. Nice.

Even if you put aside the almost instant validity such an experiment would give to conspiracy theories like chemtrails and HAARP, it still sounds a bit too much, playing with our thin air like that — in an unprecedented, and potentially catastrophic, manner, too.

But let’s not kid ourselves. The plug wasn’t pulled over fears of playing fast and loose with the venusformation of Earth’s atmosphere.

Nor was it due to the Harvard faculty’s occasional (yet frequent) dalliance with plagiarism or concerns over the lack of diversity within the ivory tower.

No, according to the MIT Technology Review, it was something else entirely: “Even studying the possibility of solar geoengineering eases the societal pressure to cut greenhouse gas emissions,” it clarified.

The Harvard Crimson picked up the scent too, noting that “a vocal minority of scientists have voiced concern that [the experiment’s] technology may provide an excuse to reduce pressure to cut emissions.”

And that’s the irony. Fixing “climate change” without destroying capitalism and everything the West stands for does nothing for the revolution.

What a waste of a good crisis!

It turns out, the climate change business thrives on more climate change alarmism. Whodathunk?

Tell me about it. My insurance premium went up 10% and the Tahoee is a year older…..Of course I’m a year older too and ‘seasoned citizens’ supposedly are higher risks as they get older.

Why auto insurance costs are rising at the fastest rate in 47 years.

As car prices moderate from a pandemic-era surge, insurance has pushed the cost of car ownership to the brink for many Americans.

New data out this week showed auto insurance costs rose 20.6% from the prior year in February, matching January’s increase as the most since December 1976, when costs rose 22.4% over the prior year.

On an annual basis, motor vehicle insurance costs rose 17.4% in 2023, the most since a 28.7% increase in 1976, according to data from the BLS.

The sticker shock hitting many American drivers is being driven by a rise in accidents, the severity of accidents, and geographical factors combining to create a perfect storm and push costs higher.

The most alarming factor driving insurance costs higher is more severe claims.

“In general, the numbers of crashes, injuries, and fatalities are up, and inflation has made the cost of repairs more expensive,” AAA spokesperson Robert Sinclair told Yahoo Finance.

Sinclair also pointed to NHTSA data, which found that in 2021, at the height of the pandemic, road fatalities increased by 10.5% to their highest level since 2005, even while most Americans stayed at home. The NHTSA said it was the highest percentage increase it had ever seen. The agency found that fatalities in 2022 only decreased by 0.3% as compared to 2021.

Insurance tech firm Insurify found that auto insurance premium hikes were “largely due to the skyrocketing price of auto parts and the increasing number and severity of claims.” And while increases may moderate, analysts still believe further premium hikes are on the horizon.

“While the magnitude of rate increases is likely to ease somewhat, after several years of double-digit increases, some lingering claim cost inflation and adverse claim severity and frequency will likely lead to a ‘higher for longer’ auto rate environment,” CFRA analyst Cathy Seifert told Yahoo Finance.

Bidenflation Is Even Worse Than You Think.

It doesn’t take a master’s degree in economics to understand that prices are up in every sector of the economy. The economy under Joe Biden is nickel-and-diming us at every turn, and Americans can see past the smoke and mirrors that the White House is using to try to convince us that everything is fine.

The federal government’s measure of price increases, the Consumer Price Index (CPI), has consistently shown that inflation isn’t going away. The most recent CPI report indicates a 3.2% increase in prices from Feb. 2023 to Feb. 2024. That’s a significant increase, but it only shows the increase over a rolling 12 months.

To get a clearer picture of what Bidenflation looks like, we need to compare prices between now and when Biden took office. That’s what TIPPinsights did, and the results show you that Bidenflation isn’t just worse than the White House wants you to believe — it’s worse than you might have realized.

“We developed the TIPP CPI, a metric that uses February 2021, the month after President Biden’s inauguration, as its base to measure the rate of change,” TIPPinsights explains. “All TIPP CPI measures are anchored to the base month of February 2021, making it exclusive to the economy under President Biden’s watch.”

The rationale is that a year-over-year comparison looks at current prices next to already inflated prices, which masks the effect of inflation over time. The TIPP CPI measures Bidenflation as a whopping 18%. TIPPinsights broke down various sectors of the economy in a similar way that the Bureau of Labor Statistics (BLS) does in its CPI.

Related: Welcome to Nickel-and-Dime Nation

Here’s a sample (emphasis in the original):

Food prices increased by 20.6% under Biden compared to only 2.2% as per BLS CPI, a difference of 18.5 points.

TIPP CPI data show that Energy prices increased by 29.6%. But, according to the BLS CPI, energy prices improved by 1.9%. The difference between the two is a whopping 31.5 points.

The Core CPI measures the price increase for all items, excluding food and energy. In the year-over-year measure, the Core TIPP CPI is 16.5% compared to 3.8% BLS CPI, a 12.8-point difference.

Further, gasoline prices have increased by 29.9% since President Biden took office, whereas the BLS CPI shows that gasoline prices have improved by 3.9%, a difference of 33.8 points.

Americans have noticed these differences in prices. Two recent TIPP polls have shown this phenomenon. One shows that 84% of American adults are concerned about inflation — 51% “very concerned” and 33% “somewhat concerned.” It’s the 25th consecutive month that over 80% of people surveyed have expressed concerns about inflation.

COOKING THE BOOKS: 11 Out Of Last 13 Jobs Reports Have Been Revised Downward.

11 out of the last 13 jobs reports have been revised down from the original headline-generating numbers.

The regime is cooking the books. pic.twitter.com/et1hbGRTkT

— End Wokeness (@EndWokeness) March 8, 2024

The purported “Economic Growth” under Biden has been bought with debt.

With a total of $1.13 trillion in debt, credit card debt that moved into serious delinquency amounted to 6.6% in Q4 2023, while it had been around 4% at the end of 2022.

Read more: https://t.co/BNKcHEzuWO

— unusual_whales (@unusual_whales) February 29, 2024

Shopping during Bidenomics……..

Retail sales tumbled 0.8% in January, much more than expected

Consumer spending fell sharply in January, presenting a potential early danger sign for the economy, the Commerce Department reported Thursday.

Advance retail sales declined 0.8% for the month following a downwardly revised 0.4% gain in December, according to the Census Bureau. A decrease had been expected: Economists surveyed by Dow Jones were looking for a drop of 0.3%, in part to make up for seasonal distortions that probably boosted December’s number.

However, the pullback was considerably more than anticipated. Even excluding autos, sales dropped 0.6%, well below the estimate for a 0.2% gain.

The sales report is adjusted for seasonal factors but not for inflation, so the release showed spending lagging the pace of price increases. On a year-over-year basis, sales were up just 0.6%.

Headline inflation rose 0.3% in January and 0.4% when excluding food and energy prices, the Labor Department reported Tuesday. On a year-over-year basis, the two readings were 3.1% and 3.9%, respectively.

This is your brain on Marxism.

Treasury Secretary: “We don’t have to get the prices down because wages are going up.”

Allow me to translate:

"Of course we're going to keep stealing your money through inflation — you're too feckless & cowardly to fight back … And otherwise we'd have to cut govt spending" https://t.co/fwPKVYdIiY

— Tom Elliott (@tomselliott) February 8, 2024

Average American family, Detroit, Michigan, 1954.

All this on a 1 income: A Ford factory worker’s wages.

What happened? pic.twitter.com/3nXzDwRLF9

— Lauren Witzke (@LaurenWitzkeDE) January 21, 2024

Most feel Christmas and retirement are Scrooged by ‘Bidenomics.’

The financial hurt the people feel from “Bidenomics” is starting to show in their approach to Christmas shopping and fear about running out of money in retirement.

In a new test of the economy, a survey done for the 85 Fund said most people feel they are “worse” off this Christmas than last.

The survey from CRC Research for the fund that supports conservative action groups and shared with Secrets said that 49% feel they are in a “worse position” to buy presents and celebrate the holidays. Some 43% said they are better off.

The 1,600 voters polled said they are very concerned about retirement as the rate hikes by the Federal Reserve rake their savings.

The survey said a whopping 81% are worried they won’t have enough to retire on, a troubling finding since the poll said that a majority, 52%, are thinking about retiring.

The poll, shown below, also found that credit card balances are rising, an early warning sign of economic troubles in the future.

The results are the latest to challenge the Biden administration’s claims that the economy is in a sweet spot of good employment and lower prices. Most people believe prices are significantly higher than during former President Donald Trump’s administration.

“Ordinary Americans are far worse off than one year ago due to the consequences of Bidenomics. Bidenflation has caused a cost-of-living crisis. The Federal Reserve’s aggressive interest rate hikes in response have made credit more expensive and difficult to attain,” Alfredo Ortiz, president and CEO of the Job Creators Network, told Secrets on Wednesday.

“It’s harder and harder to make ends meet, especially for women who generally manage household finances. President Biden and the liberal media continue to claim the economy is great, but real Americans, as this poll reiterates, know otherwise,” he added.

Will Hild, executive director of Consumers’ Research, said, “As the Biden administration continues to force its ineffective economic agenda on the American people, consumers are continuing to feel the strain of inflation and higher prices. American consumers are paying more for less. We need leaders who focus on economic policies that help consumers and stimulate the economy, rather than ones who push bad policies, like climate activism, that are driving up costs.”

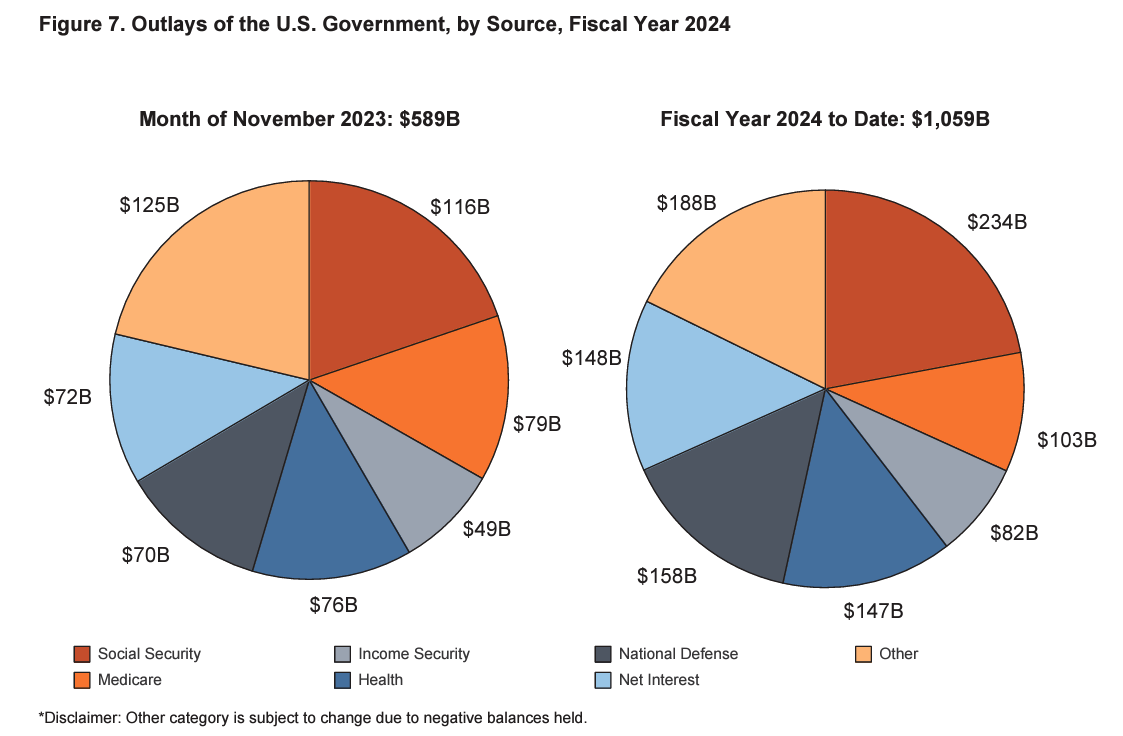

Biden Administration Runs Record November Budget Deficit

The Biden administration just ran the largest November budget deficit in history.

And it managed this feat even with a 9% increase in government receipts.

The November budget shortfall came in at $314.01 billion, according to the Monthly Treasury Statement. That was 26% higher than the November 2022 deficit.

Just two months into fiscal 2024, the federal government has run up $380.58 billion in red ink. This follows on the heels of the third-largest annual budget deficit in history.

The US government took in $274.83 billion in revenue. That was up from $252.11 billion in November 2022, bucking the trend of generally declining government receipts.

The federal government enjoyed a revenue windfall in fiscal 2022. According to a Tax Foundation analysis of Congressional Budget Office data, federal tax collections were up 21%. Tax collections also came in at a multi-decade high of 19.6% as a share of GDP. But CBO analysts warned at the time that it wouldn’t last. And it didn’t. Government receipts fell by 9.3% in fiscal 2023.

Government tax revenue will decline even faster as the economy spins into a recession.

But the real problem is on the spending side of the ledger.

The Biden administration blew through $588.84 billion in November, up 18% from November 2022. That pushed total spending to nearly $1.06 trillion through the first two months of fiscal 2024.

This underscores the fact that the fundamental issue isn’t that the US government doesn’t have enough money. The fundamental problem is that the US government spends too much money. Despite the pretend spending cuts, the debt ceiling deal didn’t address that problem. Even with the new plan in place, spending will go up. No matter what you hear about spending cuts, the federal government constantly finds new reasons to spend more money.

Latest Inflation Report Brings More Bad News for Americans Ahead of the Holidays

The latest print of the Consumer Price Index measuring inflationary pain that continues to be felt by Americans showed that no, inflation is still not coming down. In November, the Consumer Price Index registered another 0.1 percent increase in the costs of goods and services paid by Americans for a 12-month increase of 3.1 percent.

Core CPI inflation — which excludes more volatile food and energy indexes — rose 0.3 percent in November for a 4.0 percent annual increase. According to the Bureau of Labor Statistics, one of the largest contributors to November’s still-increasing inflation was the cost of shelter, which has spiked 6.5 percent over the last 12 months. In addition, the food index has risen 2.9 percent in the last year.

As House Ways and Means Committee Chairman Jason Smith (R-MO) pointed out on Tuesday morning following the release of November’s CPI that showed prices are now 17.4 percent higher than they were when President Joe Biden took office:

This Christmas, thanks to President Biden’s inflation crisis, many parents will struggle to afford that holiday meal with family and friends or presents for their kids. The extra expense of the holidays is an unwelcome reminder of the already high cost families are facing. Instead of doing anything to help families struggling to afford the cost of living, out-of-touch Democrats prefer to pretend that prices are falling and small businesses are thriving. Working families leaving items unchecked on their kid’s Christmas wish list know the truth.

As a result of inflation, American workers’ real wages are down 3.7 percent since Biden took office as a result of more than 24 straight months in which inflation outstripped wage growth, and the Federal Reserve’s reaction to inflation — raising interest rates to their highest levels since early 2001 — means mortgage rates hit a more than two decade-high this fall at 7.8 percent while credit card debt broke records to surpass $1 trillion.

President Biden and Democrats, of course, will ignore the reality of the economic hardship being faced by Americans as a result of their tax-and-spend binge that set off inflation. They, thanks to a heavy assist from its stenographers in the mainstream media, will take an undeserved victory lap on Tuesday’s CPI report.

The Associated Press provided a clear example of ignoring the literal numbers of the CPI report — which showed an increase in headline CPI, core CPI, monthly, and annual numbers — to claim that inflation “ticked down again.”

All eyes now turn to the Federal Reserve as it considers what to do with interest rates this week — whether to maintain a pause in rate increases or turn the pressure up again with another increase for the Fed’s target rates as Fed Chairman Jerome Powell & Co. seek to return inflation to its target of just two percent.