Dow roars back from coronavirus sell-off with biggest gain since 2009, surges 5.1%.

Stocks rebounded sharply from their worst week since the financial crisis on Monday, with the Dow Jones Industrial Average posting its best day in more than a decade. Expectations that the Federal Reserve would cut rates drove the gains, which accelerated aggressively into the close.

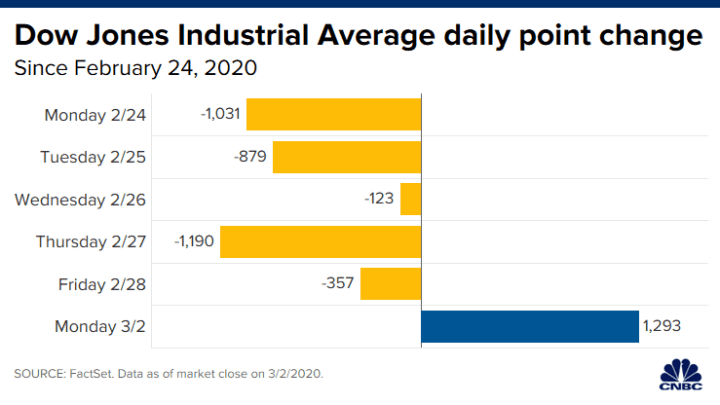

The Dow closed 1,293.96 points higher, or 5.1%, at 26,703.32. The move on a percentage basis was the Dow’s biggest since March 2009. It was the largest-ever points gain for the 30-stock average.

The S&P 500 climbed 4.6% — its best one-day performance since Dec. 26, 2018 — to close at 3,090.23. The Nasdaq Composite also had its best day since 2018, surging 4.5% to 8,952.16.

Monday’s gains snapped a seven-day losing streak for the Dow.

Apple shares led the Dow higher with a 9.3% jump; Merck and Walmart gained 6.3% and 7.6%, respectively. Utilities, tech, consumer staples and real estate all rose more than 5% to lead the S&P 500 higher.

The major averages were coming off a massive decline from the week before as worries over the coronavirus spreading dented investor sentiment.

“The market has been conditioned to buy on any weakness,” said Keith Buchanan, portfolio manager at GLOBALT. “We’ve grown accustomed to bad days being followed by a few good days in a row.”