GDP Misses as US Economy Grows Only 2% in Q3, Weakest Growth Since COVID Struck

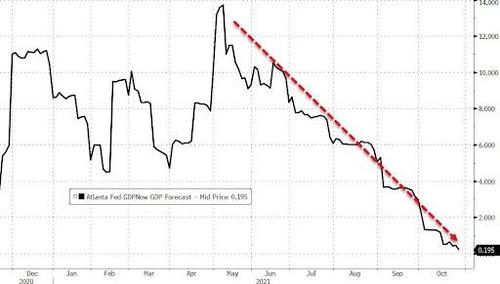

With the Atlanta Fed cutting its GDPNow estimate to just 0.2% yesterday…

… there were big worries that today the BEA could reveal a shocker of a number, one far below the rapidly falling consensus estimate of 2.6%. Well, the Q3 GDP number just came out and it was bad, but not nearly as bad as it could have been: at 2.0%, it did indeed miss the 2.6% consensus by a lot but it could have been far worse.

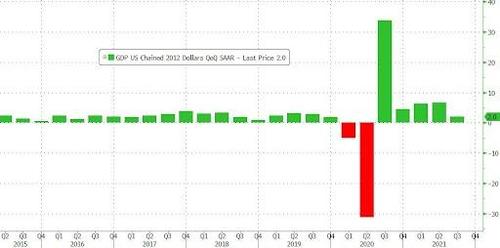

The third quarter GDP, which was the lowest since the Covid-collapse quarter of Q2 2020 when GDP crashed more than 30%, was a big drop from the 6.7% final Q2 GDP estimate, and the question now is how much further will subsequent revisions shrink the initial print and whether Q3 marks the lowpoint for US GDP or will Q4 be even worse.

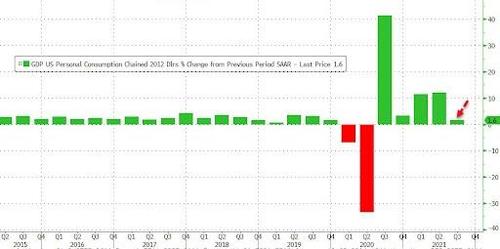

The deceleration in real Q3 GDP was led by a slowdown in consumer spending, which dropped to 1.6% from 12.0%, but was nonetheless a beat to expectations of an even worse, 0.9% print. Shortages, transportation bottlenecks, rising prices and the delta variant of the coronavirus weighed on both goods and services spending. Meanwhile, investment was a positive contribution, thanks mainly to businesses restocking depleted inventories. Trade was a negative, but has been a negative for some time. Government was a marginal factor, as it has been in recent quarters. It comes down to consumers not being able to buy as much as they want, effectively, thanks to supply-chain issues.

According to the BEA, the slowdown was due to a resurgence of COVID-19 cases resulted in new restrictions and delays in the reopening of establishments in some parts of the country. In the third quarter, government assistance payments in the form of forgivable loans to businesses, grants to state and local governments, and social benefits to households all decreased.

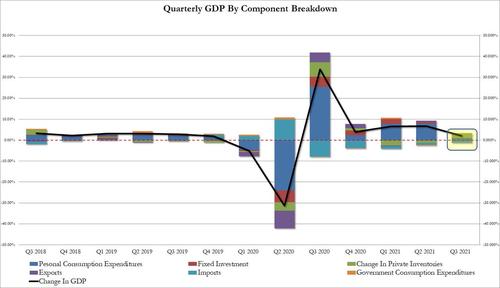

Looking at the GDP components, Q3 GDP reflected increases in inventory investment, consumer spending, state and local government spending, and business investment that were partly offset by decreases in housing investment, federal government spending, and exports. Imports, which are a subtraction in the calculation of GDP, increased.

- The increase in inventory investment primarily reflected increases in wholesale (led by nondurable goods industries) and retail(led by motor vehicle and parts dealers).

- The increase in consumer spending reflected an increase in services, led by “other” services (mostly international travel), transportation services, and health care. Consumer spending for goods decreased (led by motor vehicles and parts).

- The increase in state and local government spending primarily reflected an increase in compensation of state and local government employees (notably, education).

- The decrease in housing investment primarily reflected a decrease in housing improvements and new single-family structures.

- The decrease in federal government spending primarily reflected a decrease in nondefense spending on intermediate goods and services. In the third quarter, nondefense services decreased after the processing and administration of Paycheck Protection Programloan applications by banks on behalf of the federal government ended in the second quarter.

Quantifying these components we get the following picture:

- Personal spending contributed 1.09%, or about half, of the bottom line 2.01% number; this was down from 7.92% in Q2.

- Fixed investment subtracted 0.14% from the final print, a sharp drop from the 0.61% contribution in Q2; Nonresidential fixed investment, or spending on equipment, structures and intellectual property rose 1.8% in 3Q after rising 9.2% prior quarter

- The change in private inventories added a surprisingly large 2.07% to the bottom line number, a sharp improvement from -1.26% in Q2. Then again judging by the number of empty shelves and bogged down supply chains, this estimate looks just a “little” unrealistic.

- Net trade subtracted -1.15% from the bottom line GDP print, a deterioration from the -0.19% net exports print in Q2.

- Finally, government added 0.14% to the bottom line number, also an improvement to the -0.36% recorded last quarter.

Putting the personal spending in context, the contribution of just personal consumption of motor vehicles and parts to the overall GDP growth number was a whopping -2.4%, the second-worst print on record after Q2 1980. Part in parcel, motor vehicle output dropped 8.3% last quarter, the first quarterly drop since the last three months of 2020. On that note, Ford Motor Co. warned yesterday that chip shortages could last into not just next year, but 2023, even if the company did anticipate improvement in supplies in coming quarters.

Indeed, when looking under the cover of consumer spending, it was purchases of goods that showed the weakness. Spending on services provided a 3.4 percentage point bump to growth last quarter. That’s the second-best of the past four quarters. But it was spending on durable goods that really weighed — wiping off 2.7 percentage point of growth last quarter. These are things like appliances and autos, which have been particularly badly hit by transport and other supply-chain issues.

Some more context: the level of spending on goods last quarter was 13.3% stronger than the final three months of 2019, before the pandemic struck. This feeds into the argument of many economists that actually inflation is at least as much a demand-side phenomenon than a supply-side one.

There’s notably bigger spending today, and yet payrolls are almost 5 million off of the peak reached in February 2020. And it’s not like new ports or transport networks were built since late 2019. So, as Bloomberg notes, there’s all this strain of extra demand, with supply capacity not having expanded: “No wonder prices are going up.”

Meanwhile, looking at the inflation aspects of the report (which are stale as they have been already disclosed in monthly PCE data), the inflation gauge is worse than expected – 5.7% for the headline, versus 5.3% median estimate. The core was a little better at 4.5%, matching the prediction after rising 6.1% in the prior quarter. But it’s still an outsize reading for the price index tied to GDP.

Commenting on the report, JonesTrading’s Lutz says this readout “does not seem to have had much impact whatsoever.” He adds that it “feels like everyone thinks the main event for the week will be tomorrow’s Core PCE print.” Also known as, he points out, the Fed’s preferred inflation measure.

Meanwhile Bloomberg rate strategist Ira Jersey notes that “one question the market will be asking itself as real growth trends are slowing amid higher inflation is will central banks, and the Fed in particular, have the willingness to fight inflation? For the Bank of Canada and others a single inflation mandate gives them cover, but for the Fed a slowing economy could spill into employment and cause the Fed to lag other, more hawkish central banks.”

And one final hot take from Paul Ashworth at Capital Economics who confirms precisely what we said back in August – the savings are all gone:“With enhanced unemployment benefits being withdrawn through the quarter, real personal disposable income contracted by 5.6% annualized, with the saving rate dropping to 8.9%, from 10.5%. That means the saving rate has now returned to its pre-pandemic level, leaving a lot less scope for households to boost their spending, although the current rate doesn’t allow for any savings accumulated during lockdowns.”