Hang a few executives or burn them at the stake and they’ll feel differently. The market is, in the end, not the only thing that can hold people accountable. It’s unwise to forget that–Prof Reynolds

BLUF:

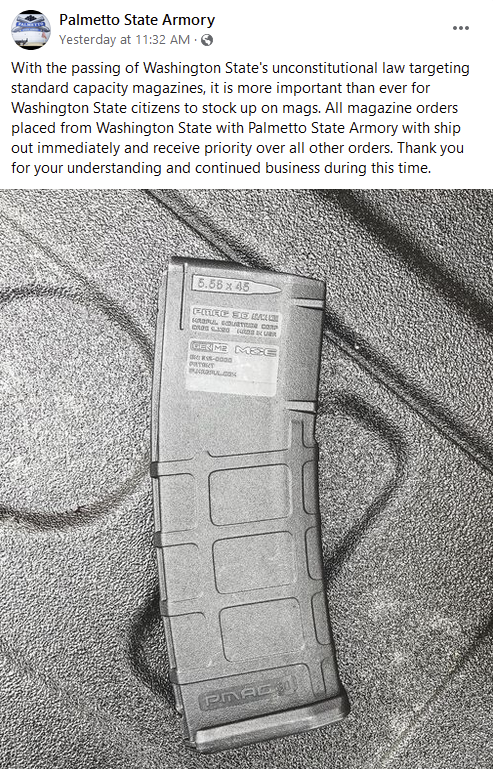

A deeper concern is what happens when private institutions like corporations, universities, and media exercise the same power without even the pretense of accountability. If the large financial institutions want to, they can act as gatekeepers to society and would be held accountable only by the market, to which they also hold the keys.

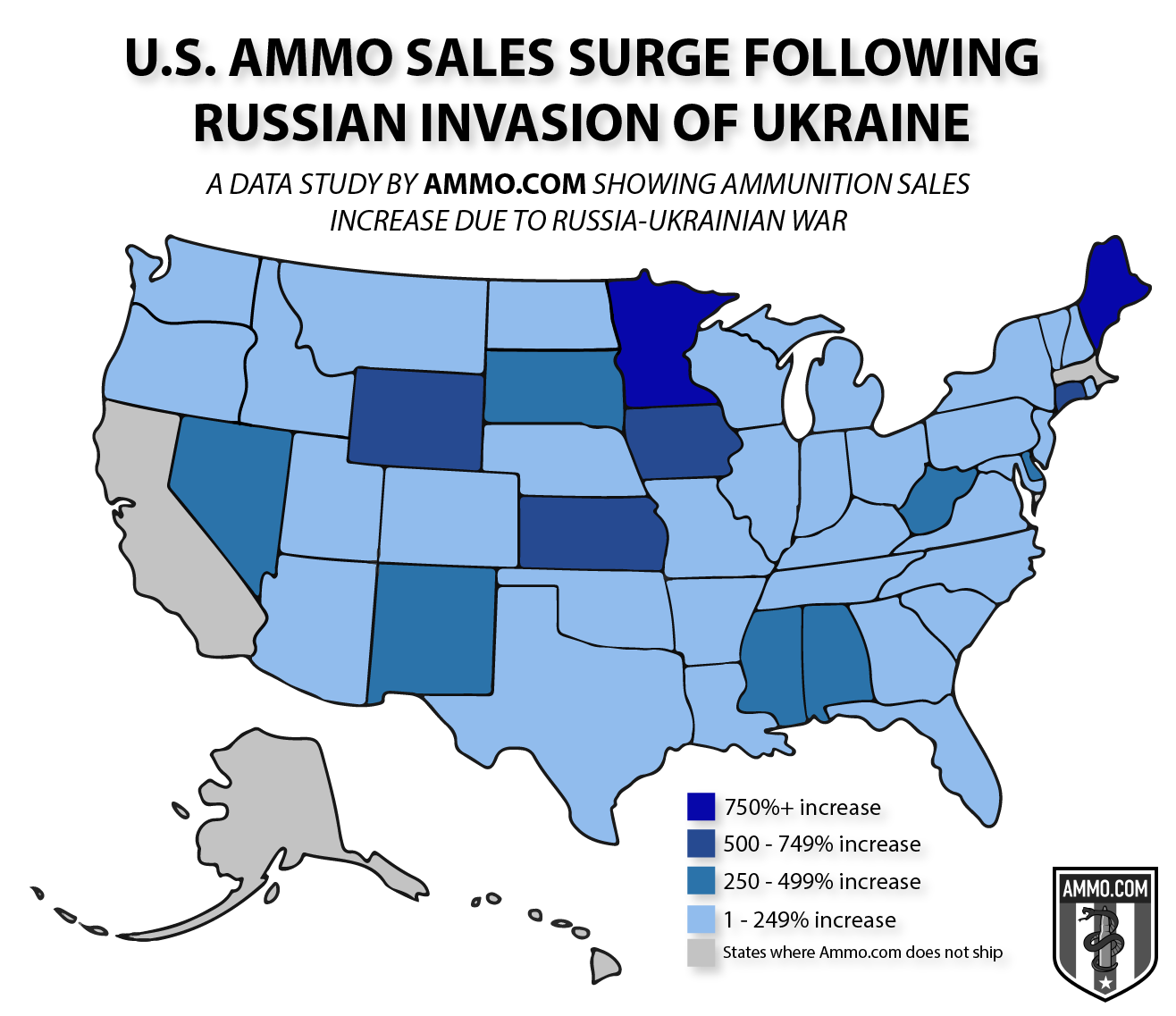

This push-button tyranny is real, and it represents a greater abuse of power than any that has been exercised before within the boundaries of liberal democratic government. It is new, it is breathtaking, and it is very dangerous.

We will delete you

Before beating a hasty retreat, Canadian Prime Minister Justin Trudeau went where no world leader has gone before. Last month, he became the first Western leader to wield the financial system as a push-button weapon of government enforcement against opinions and behaviors that he found politically distasteful or inconvenient. This is an entirely new form of power, which much of the world has not even begun to reckon with—but which may well define our politics in the years to come.

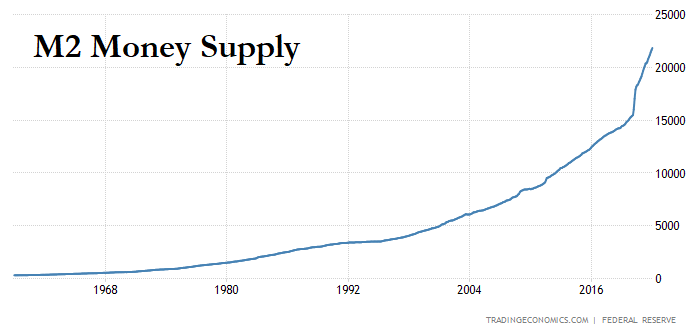

The unification of finance and technology has allowed for new forms of trade, commerce, and business. The ability to make purchases worldwide, bank from home, do taxes on your couch, and get faster approval for financial instruments like mortgages makes our lives easier. But all of this comes with a catch: The same technology that delivers instant banking and worldwide access to things we like also creates the possibility for abuse of power the likes of which we have never seen.

In order to understand the problem that faces us now, we first need to understand two concepts: real-world friction and financial centralization.

To grasp the idea of real-world friction, let’s take the example of arresting, convicting, and jailing a citizen in a democracy. In order to make an arrest, a police officer must be hired and given the authority to make the arrest. He must locate the individual he needs to arrest. He must identify that individual. He must physically perform the arrest by placing handcuffs on the individual, and take him to a holding facility where he must read the arrestee his rights. As you can imagine, finding people and taking them to jail is a time-consuming, tedious, and difficult process.

Continue reading “”