The prevailing urban attitude is:

“What do those dumb country hicks know about anything important?”

Rash wolf policy already wrecking ranches.

Don Gittleson’s ranch is situated just south of the Wyoming line near Walden. The ranch itself is surrounded by hills, and there are no big city lights to take your eyes off what matters. This is big country, this is ranch country, and Gittleson has been here for years. He has used good purebred genetics to build a herd of high-performing cattle that can, as they say, go out and make a living. Unfortunately, Gittleson’s ranch is also the epicenter for the wolf mess in which the state is currently elbow deep.

At night, the cow herd lies together, calves at side, gestating, lactating and ruminating, turning stout native grass and feed into beef. The only sound disrupting the soft noises of the night is the idling of Gittleson’s pickup.

Since December, he has spent an excessive number of nights in his pickup, waiting to hear the cattle or burros signal the presence of wolves. The pack, which Colorado Parks & Wildlife estimates at about eight, naturally migrated from Wyoming. Gittleson said he’s seen tracks for a number of years quietly announcing the presence of the apex predators.

Last fall, a collared female began teaching her pups to hunt. They started with deer and elk, killing groups and leaving them where they dropped in the snow. In December, Gittleson lost the first heifers to the pack. Some were killed, others were found bleeding and too severely injured to survive. The most recent kill — a calf — was partially dragged away. Gittleson said he guesses the meat was taken to the female, likely in a den with a new litter of pups. If history repeats itself, those pups will begin learning to eat beef before the new year.

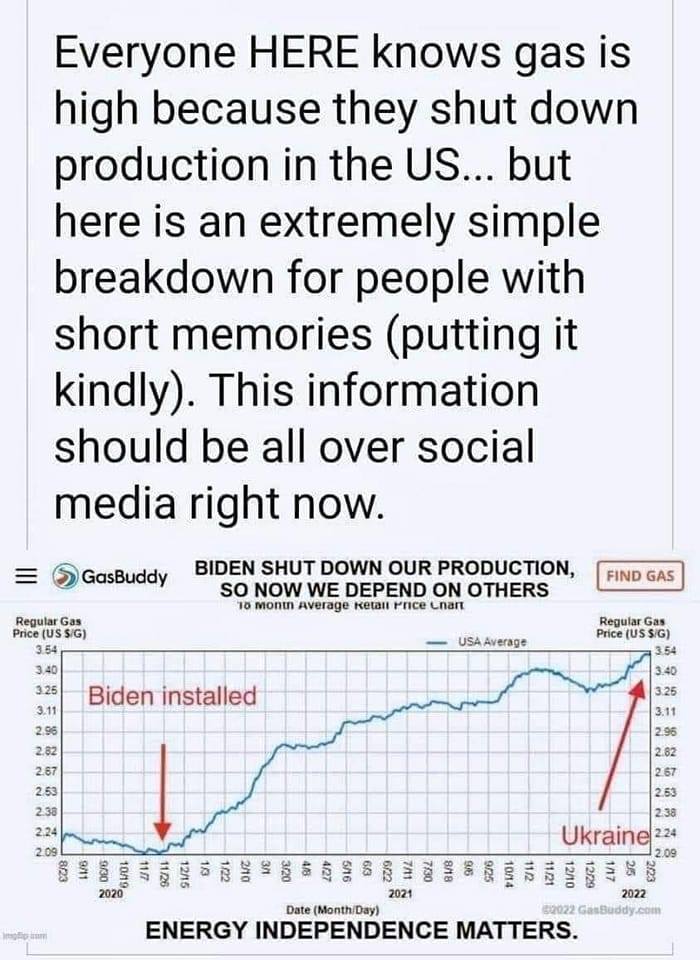

Range riders are present overnight but it’s an expense he won’t be able to continue indefinitely. Right now, they’re on the dime of wolf-advocate groups but he doesn’t expect that to last and with five of the six damage claims unpaid and $5 diesel fuel, it doesn’t pencil. The most recent kill, he said, was while range riders were in the area. The wild burros that were gifted to Gittleson in the hopes that they would serve as guardians are, he said, able to noisily signal danger but certainly don’t fight off wolves.

The bottom line, he said, is that non-lethal hazing methods are ineffective if the wolves don’t have a fear of the use of lethal methods. The wolf pack is emboldened and unafraid. Without lethal methods, the next generation will learn to kill livestock and on and on until there is a large number of problem wolves across a large area. All of this, of course, playing out prior to the first released wolf ever hitting the ground.

The misguided ballot initiative, one that left the hands of actual experts tied, flung wide open the door to out-of-state activist groups and their cash. The state-level protection of wolves has taken more tools out of the management toolbox. It has become, and will continue to be, urban and suburban voters drowning out the votes of the rural areas that actually have to deal with the fallout.

While all of this is happening at Gittleson’s ranch, the CPW Commission is hearing and reviewing the Technical Working Group’s proposed management plan. The TWG, one of two groups along with the Stakeholder Working Group, wants to see the state take a phased approach to wolf introduction, eventually de-listing them, and, clutch your pearls, classifying them as either game or non-game species. The potential of bringing the wolf numbers to a level at which they are no longer fragile and may be managed by lethal methods outraged wolf advocates at the meeting.

The other realization that was brought forth during the meeting is an explanation of the territory each pack occupies. With the proposed 200 wolf population in the state, the wolves would occupy about 10% of the western slope. That means, one expert pointed out, it is more than entirely likely that the wolves will migrate into the Front Range and eastern Colorado. I can only imagine the Front Range voters who approved the measure questioning why the wolves aren’t kept on the other side of the state and not in their backyards.

With CPW required to move forward with wolf introduction, there is no ability for wildlife experts to make decisions based on what is best for wolves in real time but, it appears, that was never part of the equation.