My theological differences with them aside, the Mormon’s doctrine of a family having a huge supply of food stocked is not a bad idea.

Jim Taylor can relate to you what happened when the Mozambique goobermint had to raise the price of staple foods. When people barely make enough money to live from day to day, a rise in price can mean starving. We’re not Mozambique, but we’ve got a lot of people living from one paycheck to the next.

BLUF

My best guess is we will see some more price increases in food-especially products that have wheat in them. It might be a good idea to buy a side of beef or pork for a home freezer. I don’t think we will run out of food. We might run out of variety, and it will be more expensive but the drivers of prices increases look to be fuel costs and interest rate costs.

We know that Ukraine is the breadbasket for a lot of Europe and Russia. The “War of Russian Aggression” has totally disrupted the supply chain. It’s not just wheat, but things like nitrogen and urea.

I have been looking for some good data on food. Frankly, I have seen my grocery bill go up quite a bit and I am trying to figure out if I should stockpile foodstuffs or not.

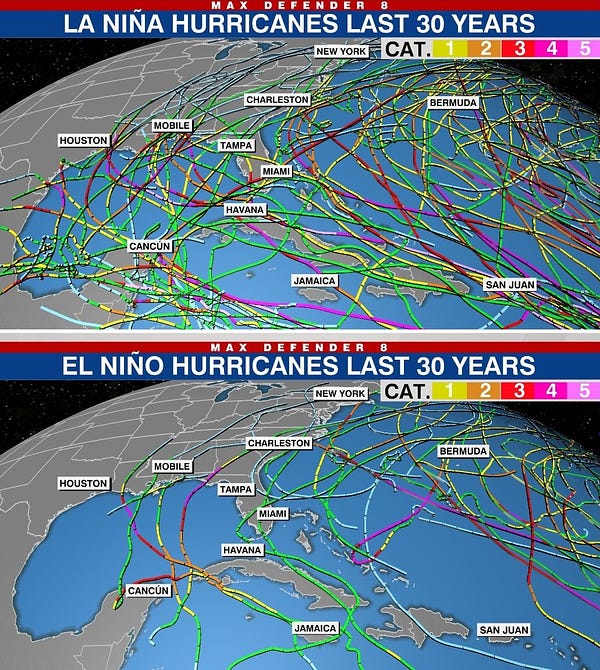

It is a La Nina year. That brings a lot of dryness to places like South America. Unscientifically, everyone I know in Las Vegas says it has been a lot windier here than normal. Expect more hurricanes this year in the southeast. Hint: It’s not global warming.

Food is totally interrelated. If Corn prices skyrocket, the price of beef will go up since the cost to fatten steers goes up. Interestingly, because of ethanol policy, corn prices get correlated with crude oil prices. I looked at a crude oil chart the other day and it doesn’t look like prices are going to go down anytime soon. Farmers are huge consumers of fuel. They use diesel in their tractors. They use a lot of propane and natural gas to heat/cool buildings and dry crops in silos. Here is a daily chart of Crude Oil Futures.

Back in 2007, Crude went to $140 a barrel. I remember it because I tried to short it. We blamed the rally on the upcoming Olympics in Beijing. The Chinese were stockpiling all kinds of commodities so they wouldn’t lose face hosting the Olympics. Virtually everything rallied, then broke hard. Oil wound up going to $35 a barrel.

I think $140/bbl of crude is totally on the table. California will see close to $10/gal diesel for sure. One of the reasons I went to Minnesota to pick up my pickup truck is it burns gasoline. My Porsche SUV burns diesel. There are rumors of diesel shortages and urea shortages. In order to operate a diesel engine on the road you have to use DEF fluid which is urea. The Joe Biden Economy isn’t helping out truckers.

I used to trade Lean Hogs, so I watched the food supply stuff relatively closely. I have heard that if you want a slot at the slaughterhouse this year, you are out of luck if you don’t have one. It’s hearsay for me as I don’t have good data on anything but my guess is that livestock farmers are going to really cull their herds this year. It’s just too expensive to feed them.

Short term, that might drive meat prices down. Long term, they will skyrocket. If you look at futures prices for lean hogs, that’s what they are telling you. Here is the near-term July contract. You can see it is off its highs, but the price isn’t low. That volume spike shows a change in direction, so it looks like to me prices might be headed back down for the short term. But, if you look at next year, prices are up.

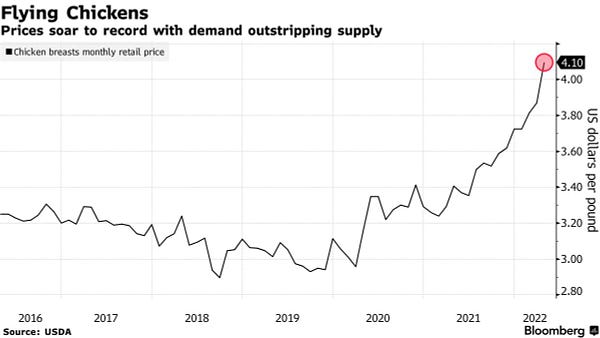

I thought this was interesting.

The third-biggest US #chicken producer said the average selling price for its chicken🐔 was about 34% higher than a year ago while costs for feed were up just 14%, driving its best earnings ever bloomberg.com/news/articles/…

That’s good! A lot of livestock farmers are carrying a lot of debt. I think the rise in interest rates, the rise in feed costs, and the drop in prices due to excess slaughter might put a lot of pressure on them.

Corn had to be in the ground by May 20th. They didn’t get the full crop in, but it wasn’t as bad as they initially thought. Corn yields will be down. Beans had to be in by May 25th. Again, the crop will be lighter than it could be, but not down as much as they thought. It will all depend on the weather this summer. Hopefully, we get good weather.

Here is a chart on wheat planting in North Dakota. You can see it is far far behind other years this year. Part of that is wet soil. Hard to plant in wet soil. If you can’t get it in, you might as well not put it in because the crop won’t be mature at harvest time.

University of Illinois Agriculture Professor Scott Irwin tweeted some interesting stats on Ukraine. Farmers there got 78% of their crop in despite the war. If the weather is good, Ukrainian production shouldn’t be off by as much as the market previously priced in.

However, Continental Europe has had trouble with its hard winter wheat crop. It’s been dry there, and unusually hot. The crop in France is way under par.

Personally, I’d like to see the government stop price supports, and subsidies, and not enact price ceilings. Ceilings and price controls will just create shortages and encourage a black market. The more we decentralize price discovery, the more efficient price will be and the better signals the market participants will get.

Milton Friedman was totally correct when he said if the government managed the Sahara Desert, in a few years we would run out of sand.

My best guess is we will see some more price increases in food-especially products that have wheat in them. It might be a good idea to buy a side of beef or pork for a home freezer. I don’t think we will run out of food. We might run out of variety, and it will be more expensive but the drivers of prices increases look to be fuel costs and interest rate costs.