WHY TEAM BIDEN MIGHT BE PURPOSEFULLY GRINDING DOWN THE MIDDLE CLASS.

Now in handy video form!

Wondering why gas has nearly doubled since Biden took office? Watch this. pic.twitter.com/X5tcDOPtT8

— RNC Research (@RNCResearch) June 2, 2022

WHY TEAM BIDEN MIGHT BE PURPOSEFULLY GRINDING DOWN THE MIDDLE CLASS.

Now in handy video form!

Wondering why gas has nearly doubled since Biden took office? Watch this. pic.twitter.com/X5tcDOPtT8

— RNC Research (@RNCResearch) June 2, 2022

Democrat Senator Brags About How Gas Prices Don’t Affect Her

During Tuesday’s Senate Finance Committee hearing to discuss “The President’s Fiscal Year 2023 Budget,” Sen. Debbie Stabenow (D-MI) displayed just how tone-deaf she is on gas prices affecting her constituents when she bragged about driving an electric car. When it comes to the price at the pump, Sen. Stabenow said, “It didn’t matter how high [the price] was.”

“After waiting a long time to finally have enough chips in this country to finally get my electric vehicle, I got it and drove it from Michigan to here this last weekend and went by every single gas station, and it didn’t matter how high it was,” Sen. Stabenow said about gas prices. “And so I’m looking forward to the opportunity for us to move to vehicles that aren’t going to be dependent on the whims of the oil companies and the international markets,” she continued.

Whatever happened to retiring in shame after being so wrong?

Secretary of the Treasury, January ’21 to date.

Member of the Federal Reserve Board of Governors from ’94 to ’97.

Chair of the Council of Economic Advisers from ’97 to ’99.

President and CEO of the Federal Reserve Bank of San Francisco from ’04 to ’10. Vice chair of the Federal Reserve from ’10 to ’14.

Chair of the Federal Reserve from ’14 to ’18.

Yellen is supposed to be THE expert on the U.S. economy.

She has no excuse to be this incompetent, unless it isn’t ‘incompetence’.

What is that line about it not being a bug, but a feature?

Biden Wants You to Know the Economy Is Super and if You Don’t Agree You’re a Moron.

In other words: The economy is doing great and if you can’t see that, you’re stupid.

Hasn’t he tried this strategy before?

Joe Biden has been tooting his own horn for over a year now by trying to take credit for the reopening of the economy after the lockdowns.

Phase one of this pivot was an op-ed in the Wall Street Journal with Joe Biden’s name in the byline (though was obviously written by someone else) claiming that the Biden administration’s “economic and vaccination plans helped achieve the most robust recovery in modern history.”

Biden’s new strategy comes on the heels of the latest economic report showing that the U.S. economic contraction in the first quarter of 2022 was even worse than expected. So, yeah… things really are going great, we’re just too stupid to notice. We’re too focused on gas prices and inflation to realize that everything is actually awesome.

Even Politico acknowledged that this strategy is likely to backfire. “Polling has shown that voters’ top concerns this year are the economy and inflation. Telling them that their day-to-day worries are not supported by macroeconomic data — or, as Biden writes, that ‘the U.S. is in a better economic position than almost any other country’ — is risky and could come across as tone-deaf, something frontline Democrats in swing districts have been concerned about.”

I think I can sum up Biden’s economic strategy in one video clip:

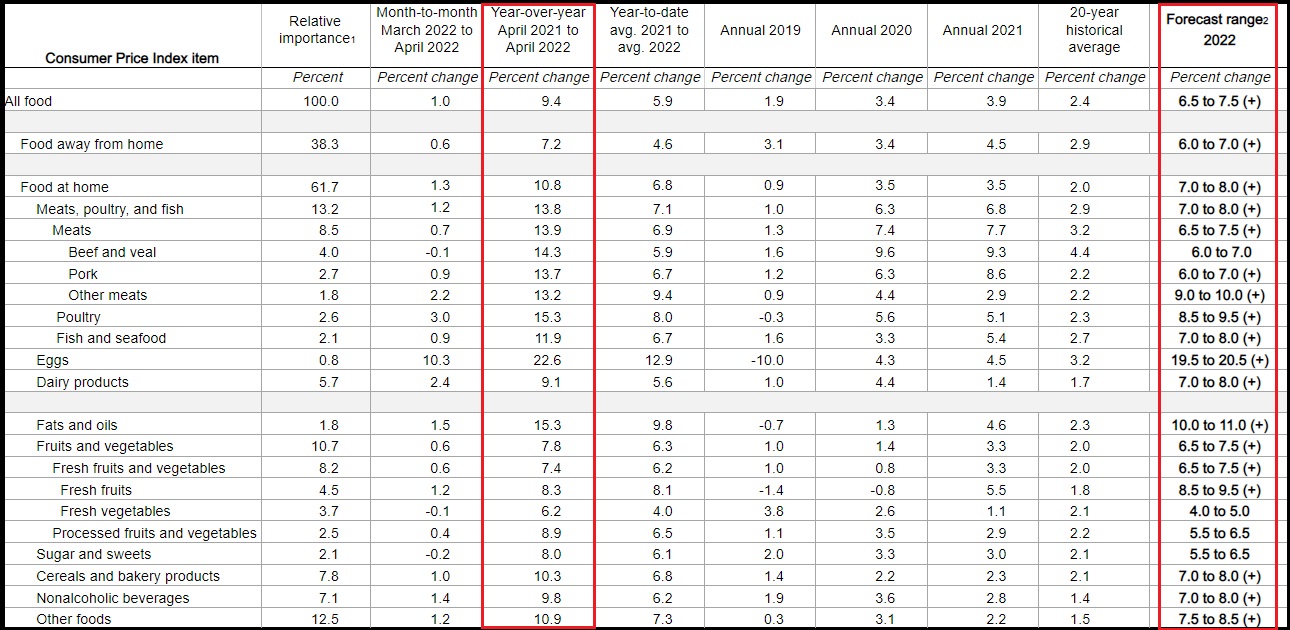

Have you ever seen egg prices at $1 per egg range, or $12/doz? Hold on a few months and perhaps you will. That is the context for the scale of food price increases the USDA is now starting to predict. The highest predicted change in food costs in well over 40 years, that’s the USDA warning in their revised May “Food Price Outlook”. [DATA HERE]

This month the USDA just re-re-revised the forward price outlook, and things are grim. It likely doesn’t come as a surprise to many CTH readers because we have been discussing the convergence of events since October of 2021, when we first were able to predict Wave-1 (Dec/Jan), and Wave-2 (March/Apr) inflation. However, the underlying data for Wave-3 is double the prior two phases.

Keep in mind the data is national & skewed toward low estimations as represented by (+).

When the USDA predicts egg prices increasing by 19.5 to 20.5% (from where those prices are now), there will be regions with much higher retail increases than estimated.

Just two months ago, USDA had egg inflation at 2.5%-3.5% range, year over year. Again, that’s the scale of change; from a 3.5% forward outlook to a 20.5% forward outlook effective right now.

Food at home (grocery store) prices: up 7% to 8% in this monthly review, versus the April outlook of a rise of 5% to 6%. That means the USDA is predicting the highest grocery store price rise since 1980 when prices rose 8.1% (prices rose 7.2% in 1981). There is no reason to think the USDA forecast will not rise again in June.

[Click graphic to expand – Data Set Here]

If you have not taken food price stability seriously before now, please take proactive measures to secure your family. We are talking about future retail food prices that were simply unfathomable last year.

You know how much prices at the supermarket have increased in the last six months. Double that, and there’s your estimation for food prices later this fall.

Behind all the datasets, statistics, BEA, BLS, USDA and analysis of these things, there are real people living paycheck-to-paycheck that are likely to be in serious food insecurity position for the first time in their lives.

I’m not talking about poor people, I’m talking about solid upper middle-class working families with kids who are already being hit hard by gasoline, energy, housing and grocery store increases. Another twenty percent increase in food costs can easily become a crisis.

The core issue is this snowball of production costs inside the field to fork supply chain. Diesel prices, fertilizer prices, energy prices, seed and feed prices, all of it has doubled and tripled in less than a year.

Add in transportation and distribution costs that have doubled, and all of that cumulative impact is going to flow through the food supply chain from the field to the processor (wholesaler), and into the supermarket. Fresh foods, especially in the produce section, will catch many people off guard.

Not all news associated with this is bad news. As you read this you have information that allows you to take control and be proactive. YOU will not be part of the national population that is stunned in September and October. YOU know what is coming. With that in mind, do what you can today, tomorrow, this week, to be proactive and offset the impact. Taking action reduces stress.

Perhaps shop proactively for your holiday shelf stable food items now. Look at the circulars and on-line for coupons, not for then – but for use now. Perhaps learn to make some of the foods you would normally purchase already prepared. Small proactive seeds, kept in mind while carrying on day-to-day life.

I know from reading comments that many of you have planted ‘victory gardens’ this year. Those harvests are worth 50% more now they were three months ago. That’s the way to look at it. Every amount of saving matters…. and yes, grandma carefully washed the aluminum foil and reused it for a reason.

My theological differences with them aside, the Mormon’s doctrine of a family having a huge supply of food stocked is not a bad idea.

Jim Taylor can relate to you what happened when the Mozambique goobermint had to raise the price of staple foods. When people barely make enough money to live from day to day, a rise in price can mean starving. We’re not Mozambique, but we’ve got a lot of people living from one paycheck to the next.

BLUF

My best guess is we will see some more price increases in food-especially products that have wheat in them. It might be a good idea to buy a side of beef or pork for a home freezer. I don’t think we will run out of food. We might run out of variety, and it will be more expensive but the drivers of prices increases look to be fuel costs and interest rate costs.

We know that Ukraine is the breadbasket for a lot of Europe and Russia. The “War of Russian Aggression” has totally disrupted the supply chain. It’s not just wheat, but things like nitrogen and urea.

I have been looking for some good data on food. Frankly, I have seen my grocery bill go up quite a bit and I am trying to figure out if I should stockpile foodstuffs or not.

It is a La Nina year. That brings a lot of dryness to places like South America. Unscientifically, everyone I know in Las Vegas says it has been a lot windier here than normal. Expect more hurricanes this year in the southeast. Hint: It’s not global warming.

If it looks, walks and quacks like a duck………….

BLUF

So does the Biden administration actually want to see middle-class Americans reduced to poverty and privation? Or is it just too stupid to foresee the obvious consequences of its own action? At this point, I’m not even sure which is worse.

But with the midterms coming, no amount of talk about gun control, abortion or other Democratic hot-button issues is going to distract Americans from what’s happening to their pocketbooks. Good.

Team Biden might be purposefully grinding down the middle class.

Vladimir Lenin supposedly once said, “The way to crush the bourgeoisie is to grind them between the millstones of taxation and inflation.”

There’s some doubt as to whether this line is genuine; regardless, it seems like a pretty good description of what the Biden administration is doing to America’s middle class.

Inflation is running rampant. The Producer Price Index, the most useful measure of general inflation, is up a whopping 16.3% from April 2021, per the Bureau of Labor Statistics.

That means that roughly $1 out of every $6 that people earn has been lost to inflation in a single year. Or to put it another way, 80 minutes’ earnings out of every eight-hour day have been eaten up.

This is predictable, of course. Team Biden took an already-bloated federal budget and supersized it with spending last year, printing money hand-over-fist to fund a massive array of pork-filled programs, many if not most of which guided billions of dollars into the pockets of Democratic Party supporters.

President Joe Biden dismissed inflation worries at the time, saying that Milton Friedman — the famed inflation-fighting economist — no longer runs the show. Well, the late economist certainly didn’t run Biden’s show, but his observation that inflation is always and everywhere a monetary phenomenon was borne out in spades as prices took off.

And it was a double whammy. Inflation comes when you have too much money chasing too few goods. The spending part provided the excess money, but the Biden team was right there helping to ensure fewer goods, too.

Gas prices going up? Not only was Biden’s spending program stimulating inflation, but at the same time Biden policies were reducing the amount of gasoline, diesel and heating oil those dollars could buy. Biden went wild canceling pipelines, ending gas and oil leases, imposing stricter environmental rules and — in cooperation with big institutional investors — choking off the finances of people trying to produce new fuel supplies.

As Sen. Dan Sullivan (R-Alaska) observed, “There has been a comprehensive hostility to the energy sector by this administration.” And how.

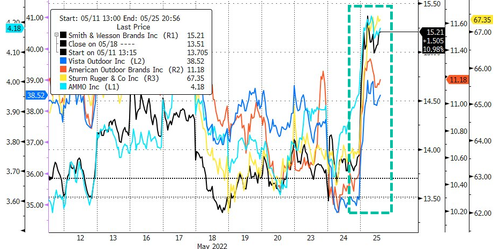

Firearm Stocks Soar Over Fears Of New Gun-Control Laws

Shares of gun and ammunition companies jumped Wednesday over speculation of new gun control laws in the wake of Tuesday’s horrific mass shooting that killed at least 19 children and two teachers at a Texas elementary school. Investors anticipate increased sales ahead of calls for stricter gun laws by Democrats.

As of Wednesday afternoon, Smith & Wesson Inc. and Vista Outdoors Inc. were both up around 10%, American Outdoor Brands Inc. +6.5%, Sturm Ruger & Co. +5.5%, and Ammo Inc. +5%.

Gun makers’ shares typically rise when Democrats call for stricter gun control measures after mass shootings because people buy on the fear that more rules could make owning a gun harder or costlier. This was the case in 2012 when gun sales soared after the shooting in Newtown, Connecticut, at Sandy Hook school.

Search trends for “buy a gun” immediately erupted Tuesday evening after the shooting at the elementary school in Uvalde, Texas.

Even though Democrats and President Biden have vowed to get tough on guns, Senate Majority Leader Charles Schumer (D-N.Y.) was out Wednesday, indicating new gun control measures would be hard to pass because there isn’t enough Republican support. Still, some fear the Biden administration will get tough on guns via executive fiat.

What about jets? pic.twitter.com/4PubXEQcA9

— Şahsıma münhasır (@aikitango2) May 24, 2022

Democrats’ Latest Phony Inflation Scapegoat: Credit Cards

In this administration, it’s always someone else’s fault. Inflation is now the No. 1 concern of voters, so the White House first blamed COVID. Then Donald Trump’s tax cuts. Then Vladimir Putin. Then meatpackers and the poultry industry, Big Oil and pharmaceutical companies.

Now, Democrats have identified a new inflation scapegoat: plastic. Visa, Mastercard, American Express and other credit cards hidden away in your wallet.

Sen. Dick Durbin (D-Illinois) has had it out for credit cards for almost two decades, even though over that period, credit cards, which were once reserved for the rich, are now nearly ubiquitous in our society. Many stores don’t even take cash anymore in the post-COVID world. The benefits and conveniences of paying with a plastic card are easily in the tens of billions of dollars to retailers and shoppers. Stores benefit because shoppers don’t have to have cash on hand to make purchases. They also benefit from not having to deal with the exchange of cash, which can lead to theft by unscrupulous employees at the register.

Credit cards are convenient for consumers because we don’t have to walk around with hundreds of dollars in our wallets.

But Democrats allege that the interchange fee that credit card companies charge retailers and merchants for their service on transactions is excessive. This interchange fee typically ranges between about 1% to 3% of the retail price of the transaction. If retailers don’t want to pay the cost because they think it is exorbitant, they don’t have to accept cards and can take cash only. Few retailers don’t take plastic every day to avoid paying the fees. It’s a free country. But the vast majority of retailers see the benefits far exceeding the costs.

Durbin, a member of the Senate Judiciary Committee, doesn’t see it that way. Instead, he blames Visa, Mastercard and Discover for making food and gas more expensive. At a recent hearing, Durbin fumed: “Today, we’re going to talk about a hidden fee that fuels the fires of inflation across America every day. What they may not know is this swipe fee is contributing to the problem of inflation.”

But for this to be true, interchange fees would have to be higher than before Joe Biden became president and before inflation surged to 8.5%.

But the fees aren’t rising. Industry sources report that over recent years, the average merchant fee (for debit, credit and prepaid cards) has fallen slightly.

By the way, merchants and retailers get concrete benefits in exchange for the fees they pay to accept credit cards. Those fees cover the cost of security and fraud protection, infrastructure improvements and consumer benefits programs such as cash back and rewards.

What Durbin and the Democrats want is government price controls on credit card companies. They say there isn’t enough competition, but there are at least five major credit cards the public can buy. There is plenty of competition in the industry. Nor is there any evidence that cutting the fees to the retailers will lead to lower prices paid by consumers at the gas pump or the grocery store checkout line.

Today, about 70% of retail transactions take place with credit cards in part because nearly everyone, except those with terrible credit histories, has a credit card these days. Projections say in the next decade, more than 80% of payments will be made with plastic as we move inevitably to digital transactions and a cashless society.

The significant impact of Durbin’s price controls will not be to tame inflation but to restrict who can get access to credit cards. In other words, the poor will get hurt the most. Isn’t that turning out to be the case with nearly every liberal policy these days?

World has 10-week supply of wheat, expert tells UN Security Council,‘This is seismic.’

NEW YORK – Global food insecurity has reached levels not seen since the financial crisis of 2008, and it’s only going to get worse without aggressive intervention, a food insecurity expert told the United Nations Security Council this week.

Russia’s invasion of Ukraine “did not start a food security crisis,” but it did add “fuel to a fire that was long burning,” said Sara Menker, CEO of Gro Intelligence, a global company that uses artificial intelligence and public and private data to predict food supply trends.

“This isn’t cyclical. This is seismic,” Menker said during a special meeting of the UN Security Council. “Even if the war were to end tomorrow, our food security problem isn’t going away anytime soon without concerted action.”

Before the Russia-Ukraine conflict began, the two countries supplied a combined one third of the world’s wheat exports and were in the top five exporters of corn. Coupled with widespread fertilizer shortages, supply chain issues and record droughts, the world has about 10 weeks worth of wheat on hand, Menker said.

“Without aggressive global actions, we stand the risk of an extraordinary amount of human suffering and economic damage,” Menker said.

We hope they can get the crops to harvest and then to the consumer.

Ukraine sows crops on over 80% of planned lands.

KYIV. May 20 (Interfax-Ukraine) – Ukraine has sown crops on 11.84 million hectares, or 82.2% of the 14.4-million-hectare area planned for this spring, including crops sown on 1,94 million hectares on May 12-19, the Ukrainian Ministry of Agrarian Policy and Food said on Friday.

Sunflower crops have been sown on 3.94 million hectares (80% of the 4.93 million hectares planned for 2022), corn on 4.17 million hectares (86% of 4.85 million hectares), spring barley on 927,500 hectares (92.6% of 1.02 million hectares), spring wheat on 188,600 hectares (99.4% of 189,600 hectares), oats on 156,800 hectares (95.8% of 163,600 hectares), and peas on 124,800 hectares (86% of 145,700 hectares) as of May 19, according to a statement published on the ministry website.

In addition, the areas sown with potatoes stand at 1.07 million hectares (90% of 1.19 million hectares), while soybeans are sown on 728,600 hectares (78.6% of 1.25 million hectares), sugar beet on 182,000 hectares (88% of 206,900 hectares), spring rapeseed on 28,400 hectares (95.3% of 29,800 hectares), millet on 32,100 hectares (51.5% of 62,300 hectares) and buckwheat on 37.400 hectares (46% of 81,600 hectares).

“The sowing is continuing in Ukraine. Spring wheat has been sown on almost 98% of the planned area,” the ministry said.

Winter crops were sown on 7.7 million hectares in 2021, including 6.5 million hectares of wheat, one million hectares of barley, and 0.16 million hectares of rye.

As reported earlier, Ukraine will reduce the sowing of highly marginal crops (sunflower and corn) this year, while increasing the area under simpler crops that are more important for food security – peas, barley and oat.

Ukrainian Prime Minister Denys Shmyhal said on April 20 that Ukraine would sow crops on approximately 14.2 million hectares this year, which is 80% of 16.9 million hectares sown with crops last year.

Earlier, the Ministry of Agrarian Policy and Food estimated the spring 2022 sowing at 13.44 million hectares, as against 16.92 million hectares in 2021.

Deputy chief of staff of the Ukrainian presidential office Rostyslav Shurma said that Ukraine was aiming at a 2022 harvest of at least 70% of the previous amounts.

Biden Admin Quietly Admits Math Error Is Causing Massive Oil, Gas Permitting Delays.

buh buh buh buh.

Energy Secretary Jennifer Granholm insisted Thursday that policies implemented under the Biden administration had no impact on the rising energy prices Americans have faced since Biden took office last year.

During a Senate Armed Services Committee hearing Thursday, Granholm was questioned by Sen. Josh Hawley, R-Mo., on what the administration is doing to lower energy prices across America and whether she believes policies put forth by President Biden are to blame for the higher costs.

Citing the cost of gasoline in his home state of Missouri, as well as projections for even higher gasoline prices during the summer months, Hawley asked Granholm whether she believed the current energy crisis Americans are facing is “acceptable.”

“No it is not,” she said. “And you can thank the activity of Vladimir Putin for invading Ukraine and pulling essentially–”

“Oh nonsense,” Hawley interjected. “With all due respect, madam secretary, that’s utter nonsense. In January 2021, the average gas price in my state was $2.07. Eight months later, eight months later, long before Vladimir Putin invaded Ukraine, that price was up over 30% and it’s been going up consistently since. What are you doing to reverse this administration’s policies that are drawing down our own supply of energy in this country that are throttling oil and gas production in the United States?”

“With respect, sir, it is not administration policies that have affected supply and demand,” she responded, shortly before Hawley interjected again.

Unless your goal is to transform society because thats a quick way to do it.

— varifrank (@varifrank) May 17, 2022

Gun Owners Need to Think Like Supply Chain Managers Before the Next Ammo Shortage.

During the two years that COVID-19 has altered American life, we have seen shortages of goods ranging from toilet paper and N95 masks to semiconductors and new cars. The supply chain disruptions that fueled those shortages often followed a general pattern.

While gun and ammunition supply chains are unique in some ways, they have experienced many of the same problems and trends seen in other industries during the pandemic.

Below, we examine how gun and ammo supply chains performed in the face of massive demand and outline supply chain principles that will help gun owners prepare for future shortages.

When uncertainty looms, demand for guns surges. Anxiety over election outcomes, civil unrest, and increasing crime rates all fuel demand spikes. In fact, the connection between gun prices and the federal election cycle is strong and predictable enough to be classified as an economic law. But the COVID-19 pandemic raised the bar considerably.

Many gun buyers seem worried that the exponential spread of COVID-19 will lead to a season of hard-to-find essentials — of illness-related disruptions in the grocery supply chain — with angry have-nots out to steal from the haves.

From the Washington Post . . .

Speaking to the Charlotte Observer, a North Carolina [firearms retailer] said, “Our new motto is, ‘Dedicated to helping you protect your toilet paper.’”

The coronavirus, supply chain disruptions, social unrest, federal economic stimulus, and a lockdown-fueled spike in durable goods spending caused unprecedented demand for guns. FBI mandatory background check records dating back to 1998 show that 2020 and 2021 saw eight of the ten busiest days for background checks and nine of the ten busiest weeks. More than 5 million Americans became first-time gun owners between January 2020 and April 2021.

While some supply chains would have buckled under such pressure — particularly during a global pandemic — the American firearms supply chain performed fairly well. Prices rose, but that was inevitable given record demand. And though some retailers experienced stockouts of popular models, they were often able to offer satisfactory alternatives from various domestic and foreign manufacturers. The robust secondary market for used guns acted as a final backstop for buyers.

While consumers were able to buy guns without too much hassle, finding ammunition proved far more difficult. This is a classic example of how fluctuations can be magnified through a supply chain.

Changes in firearm demand cause even larger changes in ammunition sales. Firearms are durable goods that can be passed down for generations if correctly maintained. And though ammunition has a long shelf life if properly stored, a marksman may go through hundreds of rounds with a single gun during a visit to the range, so each gun sale causes demand for many more bullets.

As new and longtime gun owners reacted to the pandemic’s uncertainty by stocking up on hundreds or thousands of rounds — and media reports about bare gun store shelves fanned the flames — ammunition manufacturers could not meet the demand.

Several factors contributed to the ammunition shortage. For example, while there are dozens of American ammo manufacturers, only four produced primers when the pandemic began. With domestic primer production capacity stretched to its limits and a primer shortage serving as a bottleneck to ammo production, some manufacturers began the lengthy process of sourcing and importing European and Asian-manufactured primers.

Manufacturing and shipping disruptions also interrupted the flow of foreign-made ammunition into the country. And while imports of Russian ammo helped mitigate the shortage early on, the Biden administration restricted those imports in September 2021 as part of its sanctions against Russia for the poisoning of Alexei Navalny, a vocal critic of Vladimir Putin.

While the shortage affected all types of ammunition, eventually popular calibers like 9mm handgun bullets and .223 rifle cartridges were easier to find than some of their more obscure counterparts.

This reduction in product variety (so-called “SKU reduction”) is a typical coping mechanism for stressed supply chains. Managers allocate scarce production capacity to their most popular offerings. You have probably noticed this in your local grocery store: while your favorite brands are still on the shelf, fewer sizes or flavors are available.

The shortage was amplified by ammunition manufacturers’ reluctance to invest too heavily in new productive capacity to meet record demand that will eventually wane. Firms in other industries made similar calculations during the pandemic, but few industries have experienced the severe “boom or bust” cycles ammo companies have seen in recent decades.

Executives who saw massive demand during Barack Obama’s presidency give way to a four-year long “Trump slump” know full well that this too shall pass.

Additionally, it is not too conspiratorial to fault big business collusion for the shortage. Two entities — Olin Corporation and Vista Outdoor — own most major American ammunition companies, so it was fairly easy to unify the industry in choosing “market stability” (and high prices) over new and risky investment in production capacity.

The pandemic has dramatically raised public awareness that supply chains exist and can be disrupted. While that was not news to longtime gun enthusiasts who have experienced previous ammunition shortages, we will highlight a few core principles of supply chain management that should help all gun owners weather the next shortage, whenever it may come.

A final principle for gun owners is to adopt a strategy of total quality management—of pursuing excellence at each stage of the supply chain, from gun and ammunition purchase to firearm cleaning and maintenance after a day at the range.

In the end, the purpose of the firearms supply chain is “rounds on target.” This requires excellence in marksmanship, which in turn requires excellence in training and equipment. Higher-order competence in “delivery” cannot exist without competence in the earlier stages of the supply chain: procurement, and inventory management.

Andrew Balthrop is a research assistant at the University of Arkansas Sam M. Walton College of Business. Ron Gordon is a Supply Chain Communications Specialist at the University of Arkansas Sam M. Walton College of Business. Doug Voss is a Professor of Logistics and Supply Chain Management at the University of Central Arkansas.

India, second-largest wheat producer, bans exports amid food supply concerns.

India, the second-largest producer of wheat, has banned exports of the commodity, due to a risk to its food security.

A Friday notice in the government gazette signed by Santosh Kumar Sarangi, the Director General of Foreign Trade, said that a “sudden spike” in the global prices of wheat was putting India, neighboring and other vulnerable countries at risk.

The export of wheat will be allowed in case of shipments where an Irrevocable Letter of Credit (ICLC) had been issued on or before the date of the notice and “on the basis of permission granted by the Government of India to other countries to meet their food security needs and based on the request of their governments.”

“The export policy of wheat against the above mentioned HS codes is ‘Prohibited’ with immediate effect except for shipments fulfilling the conditions mentioned in [paragraph 2 above which will be allowed as per the procedure outlined in Para 1.05 (b) of the Foreign Trade Policy, 2015-2020,” the director wrote.

Even though it is the world’s second-largest producer of wheat, India consumes most of the wheat it produces.

The nation had set a goal of exporting 10 million tons from 2022 to 2023, much of which would have gone to other developing countries like Indonesia, the Philippines and Thailand.

India’s wheat harvest has suffered from record-breaking heat and its own stocks have been strained by the distribution of free grain during the COVID-19 pandemic.

Other countries are also grappling with poor harvests that hinder their ability to help offset shortfalls due to Russia’s war in Ukraine.

Before the invasion, Ukraine and Russia accounted for a third of global wheat and barley exports.

Global wheat prices have increased by more than 40% since the beginning of the year.

Earlier this month, the United Nations’ Food and Agriculture Organization (FAO) slightly cut its projection of world wheat production in 2022 to 782 million tonnes, from 784 million last month.

Well, he’s always been known as a liar

I know gas prices are painful. My plan will help ease that pain today and safeguard against it tomorrow.

I'll continue to use every tool at my disposal to protect you from Putin’s price hike. And I’m calling on Congress to put aside partisanship. Let’s meet this moment together.

— President Biden (@POTUS) April 1, 2022

The Biden administration has canceled one of the most high-profile oil and gas lease opportunities pending before the Interior Department. The decision comes at a challenging political moment when gas prices are hitting painful new highs. https://t.co/9WzYVxEPYX

— CBS News (@CBSNews) May 12, 2022

Ford Reports Devastating Losses Thanks to Electric Vehicle Gamble.

Major U.S. automaker Ford blamed its sizable investment in electric vehicle (EV) company Rivian for its dramatic revenue decline in the first quarter of 2022.

Ford reported revenue of $34.5 billion between January and March, a 5% decline relative to the same period in 2021, and a net loss of $3.1 billion, according to the company’s earnings report released Wednesday. The Detroit automaker said its large investment in Rivian accounted for $5.4 billion in losses during the first quarter.

“A net loss of $3.1 billion was primarily attributable to a mark-to-market loss of $5.4 billion on the company’s investment in Rivian,” Ford said in the earnings report.

Ford maintains a roughly 12% stake in Rivian, CNBC reported in November.

Rivian has posted massive profit losses of its own and its share price has plummeted nearly 70% over the last six months. The value of Ford’s roughly 102 million Rivian shares has fallen from about $17.5 billion to $3.2 billion since November.

“The capability of this business is much stronger than what we were able to provide in the quarter,” Ford CFO John Lawler said Wednesday, The Wall Street Journal reported.

Rivian, a California-based company founded in 2009, went public in November, according to the WSJ. Investors quickly scooped up shares of the startup EV maker at the time, but recent poor performance has driven many investors away.

In the final three months of 2021, Rivian reported a net loss of $2.5 billion.

Automakers have increasingly turned their attention toward manufacturing electric vehicles as governments push aggressive green energy plans. President Joe Biden has promised to craft policies to ensure 50% of new vehicle sales in the U.S. are emissions-free by 2030 and every addition to the federal government’s 600,000-vehicle fleet is electric by 2035.

However, Rivian CEO RJ Scaringe recently suggested that the supply chain for EV batteries is still far behind where it needs to be to achieve many of the goals pushed by Western governments, the WSJ reported.

“Put very simply, all the world’s cell production combined represents well under 10% of what we will need in 10 years,” Scaringe said last week. “Meaning, 90% to 95% of the supply chain does not exist.”

Observation O’ The Day

YEP, THAT’S BIDEN’S STAGFLATION THAT JUST ARRIVED:

That 1.4 percent contraction in the economy in the first quarter of 2022 represents the first statistical evidence that we’re entering a period of roaring inflation and stagnate growth.

“The trade deficit ballooned massively, due to mushrooming imports. American exports fell by 9.6 percent, while imports went up by 17.7 percent. Economists had predicted a 1 percent economic growth rate, rather than the decline in the economy that actually occurred,” reports Liberty Unyielding’s Hans Bader.

And the cause is clear, according to Bader, who says “the economy is being held back by Biden administration policies that discourage work, reward idleness, and make it harder for companies to attract employees. Biden enacted policies that reduced the size of America’s private-sector workforce and made America less economically competitive.”

It’s almost like it’s a plan.

BLUF:

If the Biden administration wanted to fight stagflation, it would be cutting red tape, encouraging business activity and investment and slashing federal spending. But it’s not doing that.

Why not?

Stagflation is staring Biden in the face — but he refuses to change course.

First we were told inflation was imaginary. Then we were told it was “transitory,” the result of COVID-inflicted supply-chain problems. Then we were told it was Russian President Vladimir Putin’s fault.

Now people are starting to admit the massive runaway spending of the Biden era has something to do with it. But we’re also facing stagflation, a mixture of inflation and slow growth, and the government also plays a role in turning inflation into stagflation.

As Milton Friedman famously warned, inflation is always and everywhere a monetary phenomenon. When the government pumps the economy up with excess dollars — something usually referred to as “printing money,” though a too-literal USA Today fact-checker hastened to assure us that much of the money created isn’t actually printed on paper — inflation results. When you have more money in the system than goods, the price of goods goes up. That’s inflation, and it’s what’s happening now.

We’re seeing it everywhere, from soaring food and gasoline costs to a housing “bubble” that looks more like inflationary pricing to increases in rents and automobile prices and just about everything else. The latest figures, meanwhile, show that the economy shrank 1.4% last quarter, making it the worst since the pandemic’s start; economists had expected 1.1% growth.

There are two ways to address inflation: Remove some of the money from the system, which the Federal Reserve did in the past via higher interest rates, and increase the supply of goods. At this point in 1980, when inflation soared, the federal funds rate was nearly 20%. Presently, it’s 0.33%.

In the Carter era, we saw not only runaway inflation but stagflation. People normally associate inflation with an overheated economy, but the sluggish Carter economy was not even close to running hot. We had economic stagnation and inflation, which led to the coinage of the term “stagflation.”

Now we’re seeing the same thing. And I suspect the reason is the same.

Scholars of administrative law refer to the 1970s as a period of “regulatory explosion.” The inflationary spiral was driven by the massive increase in spending under Democratic President Lyndon Johnson. But when Republican Richard Nixon came in, he didn’t do enough to restrain spending. Worse yet, he midwifed the greatest expansion of federal regulatory authority since the New Deal. In fact, in many ways the regulation was more intrusive and pervasive.