Mr President

You're MISLEADING us 😆😆

✔Your veto is forcing investment decisions to be BASED ON POLITICS, Not financial criteria

✔You're killing competition by FORCING YOUR (ESG Factors) funds are notorious underperformers & high-risk leaving future of RETIREES LESS SECURE— Naoufal Houjami 🇺🇸 (@ForTexasHoujami) March 20, 2023

Category: Economy

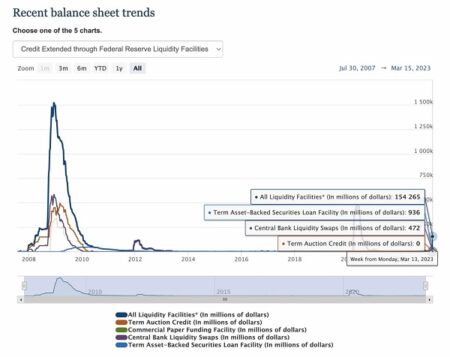

‘Backdoor bank bailout’

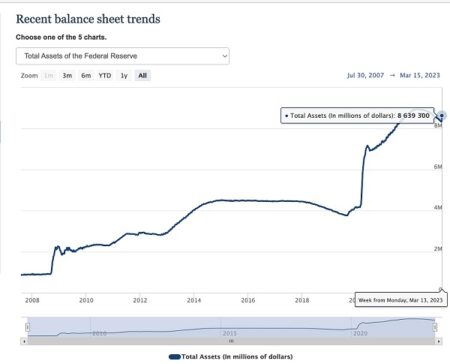

US Federal Reserve Balance Sheet Grew $300 Billion in the Last Week.

The US Federal Reserve has increased its balance sheet by about $300 billion in the last week during the banking crisis. The US Federal Reserve had been quantitative tightening from $9 trillion to $8.3 trillion, but has added $300 billion to its balance sheet.

Instead of one huge nuke installation, taking decades to license and build, consider the idea of multiple sites providing power to several subdivisions.

Scrap all these forest of windmills.

Britain backs Rolls-Royce effort to develop micro-reactor to power moon base.

March 17 (UPI) — Britain is pinning its hopes on nuclear power becoming the energy source that will fuel the next phase of human exploration of the moon, the country’s space agency said Friday.

Announcing $3.5 million funding for Rolls-Royce research into how nuclear could be used to power a manned base on the moon, the U.K. Space Agency said the technology would provide the power for humans to live and work on the lunar surface, dramatically increasing the duration of missions.

The agency said the funding was for Rolls-Royce to deliver an initial demonstration of a lunar modular nuclear reactor based around the company’s existing Micro Reactor technology, with a working reactor ready to send to moon by 2029.

“All space missions depend on a power source, to support systems for communications, life-support and science experiments. Nuclear power has the potential to dramatically increase the duration of future lunar missions and their scientific value,” it added.

Rolls-Royce said the latest funding round was highly significant for its Micro-Reactor which, compact and lightweight compared with other power systems, is capable of generating continuous power regardless of location, available sunlight, and environmental conditions.

“We’re proud to work collaboratively with the U.K. Space Agency and the many U.K. academic institutions to showcase the best of U.K. innovation and knowledge in space,” said Rolls Royce Director of Future Programs Abi Clayton.

“This funding will bring us further down the road in making the Micro-Reactor a reality, with the technology bringing immense benefits for both space and Earth. The technology will deliver the capability to support commercial and defense use cases alongside providing a solution to decarbonize industry and provide clean, safe and reliable energy.”

Science, Innovation and Technology Minister George Freeman said nuclear space power was anticipated to create new skilled jobs across the Britain that would support its fledgling space economy.

“Space exploration is the ultimate laboratory for so many of the transformational technologies we need on Earth: from materials to robotics, nutrition, cleantech and much more,” said Freeman.

The partnership with Rolls-Royce comes two weeks after the agency announced $62 million of funding for British companies to develop communication and navigation services for missions to the moon, as part of the European Space Agency’s Moonlight program.

Moonlight aims to launch a constellation of satellites into orbit around the moon.

The satellites will allow astronauts, rovers, science experiments and other equipment to communicate, share large data streams including high-definition video, and navigate safely on the surface of the moon.

So the Federal gov has to pay billions of dollars when this should have been handled by private companies? https://t.co/3j9wb58cKf

— John R Lott Jr. (@JohnRLottJr) March 17, 2023

Quote O’ The Day

Social Justice is bad enough by itself, but it’s also a marker for those incapable of thinking clearly enough to focus clearly on their main jobs.

More On How SVB Screwed The Pooch.

I wasn’t planning on writing more about the collapse of Silicon Valley Bank, but too much info has been coming down the pike to ignore. Plus, I found the video below, and felt I had to share it.

First up: Silicon Valley Bank donated nearly $74 million to #BlackLivesMatter and associated causes.

A newly published database from the Claremont Institute has revealed that the since-collapsed Silicon Valley Bank donated or pledged to donate nearly $74 million to the Black Lives Matter movement and related causes.

In an August 2020 Diversity, Equity & Inclusion report, SVB declared “we are on a journey committed to increasing diversity, equity and inclusion (DEI) in our workplace, with our partners and across the innovation economy.”

The bank revealed that they had donated $1.6 million to “causes supporting gender parity in innovation,” as well as $1.2 million to support “opportunities for diverse, emerging talent in innovation.”

In SVB’s 2021 Proxy Statement, the bank wrote in relation to racial and social equity that “the calls to end systemic racial and social inequities following the murder of George Floyd in May 2020 had a profound global impact.”

“We responded by expanding opportunities for dialogue, including hosting over 40 small group ‘Conversation Circles’ in which over two thirds of our employees participated in discussions about racial equity issues.”

The statement continued to say that the bank’s “DEI-focused ‘town hall’ meetings for employees were in response to our recognition of the need for greater transparency and dialogue around the racial representation of our workforce and the innovation ecosystem.”

In addition, the bank, provided “opportunities for action, mobilizing our employees and clients to join in community service through Tech Gives Back, a week of volunteer events focused in part on racial equity, social justice and access to the innovation economy,” and partnered with “Act One Ventures to launch The Diversity Term Sheet Rider for Representation at the Cap Table initiative, which advocates for venture capital firms to include in all of their term sheets a pledge to bring members of underrepresented groups into deals as co-investors.”

A 2020 letter from CEO Greg Becker stated, “In recent months, we’ve expanded our philanthropic giving through corporate donations and employee matching programs. These programs focus on pandemic response, social justice, sustainability and supporting women, Black and Latinx emerging talent and other underrepresented groups. You’ll find examples of these programs in this report, ranging from workforce development to affordable housing.”

In 2020, the bank launched its Missions program, “a software platform designed to engage employees to act in support of the causes they care about most such as voter education and racial justice and equity,” which saw employees donate $400,000 for “justice and equity for Black Americans.”

According to the Claremont Institute, an additional $250,000 was allocated by the SVB Foundation to support grants for social justice organizations including the NAACP, ACLU, and National Urban League.

SVB additionally partnered with 44 organizations focused on furthering DEI in innovation and invested in relationships with historically black colleges and universities, and hosted internships and provided tuition assistance for students from “underserved communities.”

In a Corporate Responsibility Report from 2021, SVB pledged to donate $50M in its diversity and inclusion programs and partnerships, “with a focus on women, Black and Latinx individuals.”

In May of 2021, SVB announced a proposed five-year, $11.2 billion community benefits plan in collaboration with The Greenlining Institute, an M4BL, or Movement For Black Lives, member. The Claremont Institute wrote that “that plan includes $75M in unspecified charitable contributions (also not included in our total).”

Social Justice is bad enough by itself, but it’s also a marker for those incapable of thinking clearly enough to focus clearly on their main jobs.

And now this video, which slams “Stupid Valley Bank” for its egregious stupidity and slams It’s Pat, which is these days is almost like a Hispster move (“It’s a pretty obscure bad movie, you’ve probably never heard of it”).

He also thinks the crisis is just beginning…

‘THAT’S A LIE:’ Janet Yellen Faces Grilling Before Senate Finance Committee.

Salient point

Biden’s refusal to work with lawmakers was brought up again by Senator Bill Cassidy (R-LA) on the issue of protecting the solvency of Social Security. Yellen tried to insist that Biden “cares very deeply” about the program, but couldn’t explain any of his actions to back up that claim. Instead, Yellen insisted Biden “stands ready to work with Congress.”

“That’s a lie,” Cassidy pointed out, as lawmakers have tried to meet with Biden on the subject to no avail.

It’s unsurprising that Biden doesn’t have a plan to address Social Security or negotiate a debt ceiling increase, considering his previous failures. From the Afghanistan withdrawal to declaring “independence” from COVID in 2021, Biden’s plans, when he does have them, don’t end any better.

SENATOR CASSIDY: "Why doesn't the president care?"

YELLEN: "He cares very deeply."

CASSIDY: "Then where is his plan?"

YELLEN: "He stands ready to work with Congress."

CASSIDY: "That's a lie! A bipartisan group of senators have repeatedly requested to meet with him!" pic.twitter.com/jpud6ai0MO

— Townhall.com (@townhallcom) March 16, 2023

“They have guaranteed the entire deposit base of the U.S. financial system,” Roger Altman, who served as deputy treasury secretary in the Carter and Clinton administrations, told CNN on Tuesday morning.

“I didn’t say it has been nationalized. I said they are verging on that because they have guaranteed the entire deposit base,” he clarified.

ROGER ALTMAN: Well, the term “bailout” is, obviously, a loaded one. And it’s in the eye of the beholder. It’s like one person sees something and thinks it is a catastrophe, and another person sees the same thing and thinks it’s a small accident.

But the main point here is that the rescues of 2008 and 2009 which we all remember so vividly became ferociously unpopular, one of the most unpopular things that the federal government has done in 50 or 100 years. Many people think they led to the growth of the Tea Party and the growth of the MAGA movement, and so forth. And therefore, the administration today doesn’t want to get within 100 miles of that term “bailout.”

Now, what the authorities did over the weekend was absolutely profound. They guaranteed the deposits, all of them, at Silicon Valley Bank. And what that really means, and they won’t say it, and I’ll come back to that, what that really means is that they have guaranteed the entire deposit base of the U.S. financial system, the entire deposit base. Why? Because you can’t guarantee all the deposits in Silicon Valley Bank and then the next day say to the depositors, say at First Republic, sorry, yours aren’t guaranteed. Of course, they are.

And so this is a breathtaking step, which effectively nationalizes or federalizes the deposit base of the U.S. financial system. You can call it a bailout, you can call it something else, but it’s really absolutely profound.

Now, the authorities, including the White House, are not going to say that, because what I just said of course implies that they have just nationalized the banking system. And technically speaking, they haven’t. But in a broad sense, they are verging on that.

By the way, the shareholders in Silicon Valley Bank, obviously, lost all their money. And therefore, if you are a shareholder at First Republic or some of the other banks that you showed on your screen a few minutes ago, you are concerned because you saw that at Silicon Valley Bank the shareholders were wiped out. But the depositors at those institutions have nothing to worry about because they have just been guaranteed.

COLLINS: It is a remarkable statement to hear you say that you believe the U.S. banking system has been nationalized because of this.

ALTMAN: Well, no. I didn’t say it has been nationalized. I said they are verging on that because they have guaranteed the entire deposit base. Usually, the term “nationalization” means that the government takes over the institution and runs it and the government owns it. That would be the type of nationalization we have seen in many other countries around the world. Obviously, that did not happen here. When you guarantee the entire deposit base, you have put the federal government and the taxpayer in a much different place in terms of protection than we were in a week ago.

No, because I know that once you get that, it will be a matter of minutes before you come after MY unrealized gains. https://t.co/wKvcuNQAN7

— Godwin Meter (@GodwinMeter) March 13, 2023

HAHAHAHAHAHAHAHAHA

NO

As soon as you give politicians the power to tax money that doesn’t exist, they will absolutely bring that power to bear against you. pic.twitter.com/29IMi915d9

— Godwin Meter (@GodwinMeter) March 13, 2023

Get woke, go broke.

The collapse of Silicon Valley Bank, the second largest in US history, is raising concerns about a “contagion” that could trigger a financial panic. As the 18th largest bank in the US, SVB’s bankruptcy may not prove an event on the scale of Lehman Brothers, but it may reflect something perhaps even more important: the decline of the Valley’s once vibrant entrepreneurial culture.

As a young reporter, I covered bank founder Roger Smith in 1983 when he came up with the idea of providing conventional financing to young, often venture-backed growth companies. In those days the big Wall Street financiers were largely clueless about technology, and the industry needed someone who understood their needs and ambitions. The now-retired Smith became a real player in the tech world, as well as in the Valley’s philanthropic scene.

Today’s Silicon Valley is not brimming as before with aggressive startups and the garage-based entrepreneurs who are the SVB’s bread and butter. Indeed, the magic that led firms and people to come to California is wearing off; Mike Malone, who has chronicled Silicon Valley over the past quarter-century, believes that this is because the Valley has lost its egalitarian ethos. The new masters of tech, he suggests, have shifted from “blue-collar kids to the children of privilege”. An intensely competitive industry, he adds, has become enamoured with the allure of “the sure thing” backed by massive capital. If there is a potential competitor they simply buy it. Innovation is therefore in short supply.

In this new oligarch-dominated Silicon Valley, there is less need for a unique bank like SVB because the entire eco-system that the bank depended on has diminished. It’s likely that the big financial institutions will now step in and pick off the strongest candidates in the start-up litter, generally those who can eventually be hived off to one of the giants.

The Valley is far from dead. It still retains an enormously deep field of technical talent and the professionals who service them. But its era of dominance is clearly ending as more companies expand or even move their headquarters elsewhere — something Hewlett Packard Enterprise, Oracle and Tesla have already done.

This “tech exodus” has, however, been underway for years; according to research by Ken Murphy, 13,000 companies left California between 2009-2016 alone. The pandemic-induced push to move work online only appears to have hastened this shift. With two out of three tech workers willing to leave the Bay Area if they could work remotely, Big Tech could readily spread talent and wealth to other states.

The Valley may remain top dog but, as unique institutions like Silicon Valley Bank disappear, there are more potential alphas lurking elsewhere in the kennel.

If anyone has learned anything, it’s understanding that Cramer is a perfect reverse barometer

CNBC’s Jim Cramer eviscerated for touting Silicon Valley Bank weeks before disastrous collapse.

CNBC’s “Mad Money” host Jim Cramer is being shredded across social media after footage resurfaced of him urging viewers in February to invest in Silicon Valley Bank (SVB), which collapsed on Friday.

SVB had been the 16th largest bank in the United States and was connected to a number of Silicon Valley industries and startups. The closure of the bank was announced by the Federal Deposit Insurance Corporation (FDIC), making it the worst U.S. financial institution failure in nearly 15 years.

Upon the news of SVB’s collapse, a clip went viral of Cramer in February speaking positively about the bank in a list of “The Biggest Winners of 2023… So Far.”

“The ninth-best performer here today is SVB financial. Don’t yawn,” he told his viewers on Feb. 8. “This company is a merchant bank with a deposit base that Wall Street has been mistakenly concerned about!”

CNBC’s Jim Cramer of “Mad Money” talking about Silicon Valley Bank.

Brother, can you spare a dime? https://t.co/n2it4aeUD9

— The Truth About Guns (@guntruth) March 10, 2023

Hours ago, we saw the biggest bank failure in the US since 2008.

Soon, the people who told you everything was fine because they were in control, will shift to saying that everything is going poorly because they don't have enough control.

— Spike Cohen (@RealSpikeCohen) March 10, 2023

BAILOUT MOTORS: GM Gutting Half Its U.S. Workforce

GM, the leading U.S. automaker by volume, will gut its U.S. workforce “voluntarily” according to a confidential internal memo from Chairman and CEO Mary Barra that leaked on Thursday.

“Accelerated attrition requires to be proactive regarding workforce planning,” Barra’s memo reads. “Therefore, today, we are announcing a voluntary program that offers the majority of our U.S. team an opportunity to leave GM and transition to what’s next with an attractive compensation and health care package.”

Putting a smiley face on the matter, Barra explained that her “Voluntary Separation Program, known as a VSP, presents an opportunity to explore a new industry, make a career change, further a personal business venture or decide you can retire earlier.”

The move is “designed to accelerate attrition in the U.S.”

What that means is, more than half of General Motors’ American workforce will have two weeks to decide whether to take the retirement package or… “Taking this step now will help avoid the potential for involuntary actions.”

From the sound of it — take the voluntary separation package before we separate you without one — employees would be wise to take the offer.

General Motors’ South Korea division will offer a similar VSP package, but workers in Canada, Mexico, Europe, and China will not, according to the memo. Whether Barra plans similarly drastic job cuts in those countries is unclear.

The company currently employs about 167,000 people in the US, spread across its four surviving divisions — Buick, Cadillac, Chevrolet, GMC — and corporate HQ.

General Motors used to sell half of all cars in the U.S. market. Now it sells one in six. How many cars it’ll be able to produce with fewer than half of today’s headcount remains unclear, and is not a topic Marra addressed in today’s memo.

How the mighty have fallen.

Here’s Barra’s memo in its entirety.

US home prices just did something they haven’t done since 2012.

US home prices in February posted their first year-over-year decline in more than a decade as surging mortgage rates put the squeeze on the market.

The average US home sold for $350,246 for the four weeks ending on Feb. 26, according to an analysis by real estate firm Redfin this week. The sale price plunged by 0.6% compared to the same month one year ago — the first annual decline since February 2012.

“Prices falling from a year ago is a milestone because it hasn’t happened since the housing market was recovering from the 2008 subprime mortgage crisis,” Redfin deputy chief economist Taylor Marr said in a statement.

“Home prices skyrocketed so much over the last few years that they were likely to come down once rates rose from historic lows,” Marr added.

Mortgage rates have jumped again in recent weeks as worse-than-expected inflation reports sparked fear that the Federal Reserve will continue hiking interest rates. The average 30-year mortgage rate rose steadily throughout the month of February and hit a whopping 7.1% as of this week.

Higher rates have exacerbated an affordability crunch and pushed many homebuyers to the sidelines. At the same time, would-be sellers are forced to either slash their asking prices or delay their plans entirely.

“Mortgage rates rising to the 7% range was the straw that broke the camel’s back, dampening homebuying demand and leading to sellers asking less for their home,” Marr added.

The largest price declines were in “pandemic homebuying hotspots,” the firm said.

Austin, Texas, posted the largest year-over-year decline of 11%.

Despite the dropping prices, first-time homebuyers are unlikely to see much relief, according to Marr.

“That’s because so few homeowners are listing their homes for sale. Limited inventory and continued interest in turnkey homes in desirable neighborhoods will keep prices somewhat propped up — and high rates will continue to be a hit on affordability.”

The price declines are most severe in so-called “pandemic boomtowns.”

While most experts agree that the US housing market is in the midst of a correction, the extent of the projected price slump is a matter of debate.

In a report earlier this week, researchers at the Dallas Fed warned that home prices could plummet by nearly 20% in the event of a severe contraction in US housing.

Last year, Redfin predicted that US home prices would fall by 4% in 2023 as mortgage rates cooled the market.

Another firm, Pantheon Macroeconomics, has projected a much sharper decline of up to 20%.

Consumers could be in a ‘world of hurt’ if Biden doesn’t act soon, former Walmart CEO warns.

Former Walmart U.S. CEO Bill Simon joined “Fox & Friends Weekend” to discuss the nationwide spike in layoffs that have now extended beyond the Big Tech industry.

Mass layoffs are plaguing more than just the Big Tech industry.

On Sunday, former Walmart CEO Bill Simon joined “Fox & Friends Weekend” to warn Americans of the detrimental impact that corporate layoffs could have on the U.S.’s feeble economy.

“It’s crazy right now. We’re stuck in this loop of wage inflation, product inflation and cost inflation. And it’s just that cycle keeps going. And I think, unfortunately, an inevitable byproduct of some of the Fed’s moves and as the necessary medicine we have to take to kind of cool things down and get the inflation back under control on some of these layoffs that are coming,” Simon told co-host Will Cain.

Although the labor market remains healthy and one of the few bright spots in the economy, there are signs that it is beginning to soften. In addition to a number of high-profile tech layoffs over the past month, the economy added 223,000 jobs in December, the smallest gain in two years.

Existing Home Sales Tumbled in December for 11th Straight Month, Falling to Lowest Level Since 2010

U.S. existing home sales slowed for the 11th consecutive month in December as higher mortgage rates, surging inflation and steep home prices sapped consumer demand from the housing market.

Sales of previously owned homes tumbled 1.5% in December from the prior month to an annual rate of 4.02 million units, according to new data released Friday by the National Association of Realtors (NAR). On an annual basis, existing home sales are down 34% when compared with December 2021.

It is the slowest pace since November 2010, when the U.S. was still in the throes of the housing crisis triggered by subprime mortgage defaults.

“December was another difficult month for buyers, who continue to face limited inventory and high mortgage rates,” NAR chief economist Lawrence Yun said in a statement. “However, expect sales to pick up again soon since mortgage rates have markedly declined after peaking late last year.”

There were about 970,000 homes for sale at the end of December, according to the report, a decline of 13.4% from November but up about 10.2% from one year ago. Homes sold on average in just 26 days, up from 24 days in November and 19 days one year ago. Before the pandemic, homes typically sat on the market for about a month before being sold.

At the current pace of sales, it would take roughly 2.9 months to exhaust the inventory of existing homes. Experts view a pace of six to seven months as a healthy level.

The interest rate-sensitive housing market has borne the brunt of the Federal Reserve’s aggressive campaign to tighten policy and slow the economy.

Housing market

At the current pace of sales, it would take roughly 2.9 months to exhaust the inventory of existing homes. Experts view a pace of six to seven months as a healthy level.

Policymakers already lifted the benchmark federal funds rate seven consecutive times in 2022 and have indicated they plan to continue raising rates higher this year as they try to crush inflation that is still running abnormally high.

Still, mortgage rates are continuing to fall from a peak of 7.08% notched in November. The average rate for a 30-year fixed mortgage fell to 6.15% this week, according to data from mortgage lender Freddie Mac. However, that remains significantly higher than just one year ago, when rates hovered around 3.56%.

However, even with higher interest rates putting homeownership out of reach for millions of Americans, prices are still steeper than just one year ago. The median price of an existing home sold in December was $372,700, a 2% increase from the same time a year ago. This marks the 130th consecutive month of year-over-year home price increases, the longest-running streak on record.

Prices, however, have moderated slightly after peaking at a high of $413,800 in June.

“The housing market is reeling from years of under-building, economic uncertainty and high interest rates,” said Jeffrey Roach, the chief economist at LPL Financial, adding: “Given the confluence of these factors, housing affordability is the lowest since the mid-1980s.”

Missouri Bill Would Take Steps Toward Treating Gold and Silver as Money

A bill introduced in the Missouri Senate for the 2023 legislative session would take important steps toward treating gold and silver as money instead of as commodities and would set the stage for currency competition in the Show-Me State.

Sen. William Eigel (R) filed SB100 last month. The legislation would take several steps to encourage the use of gold and silver as money in Missouri, including making it legal tender, eliminating the state capital gains tax on gold and silver, and establishing a state bullion depository.

Legal Tender and Tax Reforms

Under the proposed law, gold and silver would be accepted as legal tender and would be receivable in payment of all public and private debts contracted for in the state of Missouri. Practically speaking, this would allow Missourians to use gold or silver coins as money rather than just as mere investment vehicles. In effect, it would put gold and silver on the same footing as Federal Reserve notes.

Missouri could become the fourth state to recognize gold and silver as legal tender. Utah led the way, reestablishing constitutional money in 2011. Wyoming and Oklahoma have since joined.

The effect has been most dramatic in Utah where United Precious Metals Association (UMPA) was established after the passage of the Utah Specie Legal Tender Act and the elimination of all taxes on gold and silver. UPMA offers accounts denominated in US-minted gold and silver dollars. The company was also instrumental in the development of the “Utah Goldback,” described as “the first local, voluntary currency to be made of a spendable, beautiful, physical gold.”

SB100 would also exempt the sale of gold and silver bullion from the state’s capital gains tax. Missouri is already one of 41 states that do not levy sales tax on gold and silver bullion. Exempting the sale of bullion from capital gains taxes takes another step toward treating gold and silver as money instead of commodities. Taxes on precious in metal bullion disincentivize investment and erect barriers to using gold and silver as money by raising transaction costs.

Retail sales drop sharply at start of key holiday shopping season

Americans cut back sharply on retail spending last month as the holiday shopping season began with high prices and rising interest rates forcing families, particularly lower income households, to make harder decisions about what they buy.

Retail sales fell 0.6% from October to November after a sharp 1.3% rise the previous month, the government said Thursday. Sales fell at furniture, electronics, and home and garden stores.

Americans’ spending has been resilient ever since inflation first spiked almost 18 months ago, but the capacity of Americans to continue spending in a period of high inflation may be beginning to ebb. Inflation has retreated from the four-decade high it reached this summer but remains elevated, enough to erode the spending power of Americans. Prices rose 7.1% in November from a year ago.

“The weakness in sales … suggests that higher borrowing costs, slower employment growth and an unusually low saving rate are now catching up with consumers,” said Andrew Hunter, senior US economist at Capital Economics.

Consumer spending is still likely to grow at a solid pace in the final three months of the year, Hunter said, but he expects a sharp drop early next year.

Monthly sales data can be volatile and one negative report is often followed by a rebound, other economists said.

Sales plunged 2.3% at auto dealers, and slipped 0.6% at sporting goods stores and 0.1% at general merchandise stores, a category that includes large chains such as Walmart and Target. Sales at online and catalog stores fell 0.9%.

The steep 2.5% decline in sales at home and garden stores likely reflects the sharp decline in home sales due to rapid interest rate hikes in the US, which have put homes increasingly out of reach for more Americans.

Solid hiring, rising pay, and enhanced savings from government financial support during the pandemic have enabled most Americans to keep up with rising prices. Yet many are now digging into their savings to maintain the same level of spending. The saving rate declined to its second-lowest level on record in October.

Americans are also putting more purchases on their credit cards. Total credit card debt jumped 15% in the July-September quarter, according to the Federal Reserve Bank of New York, the biggest jump in 20 years.

Shopping at a Walmart in New Jersey, Eric Cruz, said he planned to cut his holiday shopping budget by roughly 20% this year, to about $800. The 33-year-old Jersey City entrepreneur said rising costs for utilities and rent now take a bigger chunk of his income. He is trying to offset rising costs by seeking out credit cards with greater rewards, like 5% back on spending.

“I am looking for extra incentives and credit cards allow me to do that,” he said.

Symptoms of economic stress are beginning to appear, retailers have noted.

Craft supplies chain Jo-Ann Stores this week announced a pause in quarterly dividends for investors after comparable store sales fell 8% during its most recent quarter, which ended in October.

I really like how the goobermint can come up with an “8.7%” inflation rate for COLAs when my grocery bill has gone up by 30+% and gas by 100%

BLUF

The economy seems to be slipping into a Carterian perfect economic storm: prices and interest rates jumping in unison, with lingering structural supply issues leaving shelves half-stocked.

The Bernank Can No Longer Hibernate

The animated ursine explainers were right. And a billionaire-backed business-first broadsheet confirms it.

Christmas has come early for Ron Paulers in the most libertarian way: their past contrarian construals are vindicated by everyone suffering. Surely Justin Amash has a path to the presidency in 2024 now!

This Thanksgiving, more budgets were busted than the front button on stretch-fit Dockers. If you didn’t notice because mommy and daddy footed the 20% higher turkey tab this year, your attention may be arrested by the $70 sum on new PS5 games. That is, inflation has not abated despite the summer passage of the Inflation Reduction Act, which, in a twist of marketing nominative nondeterminism, had zilch to do with quelling swelling prices.

The consumer price index punched in at 6.3% in October, when compared to last year. While that percentage bump is less than the nearly 10% YTD rate in June, the cost jumps are still historically high. And if you’ll excuse me… *unrolls a sheet of tinfoil, folds it firmly into the shape of a conical hat, turns the cooktop burner on to singe the tip so it generates extra-hot takes, places tightly on head.* Everyone knows (if you disagree, you’re not everyone, and therefore an outcast—the perfect phrasal conspiratorial cordon!) that the CPI is deliberately calculated to underplay the actual inflation rate. Volatile commodities are excluded to provide a more stable picture. The Bureau of Labor Statistics, whose abacus-brained technocrats fashion the CPI, use something called the “hedonic quality adjustment” to anticipate vittle variation—which really just sounds like a john settling for a veteran flesh house servicer than a fresher offering based upon his thin wallet.

The point is, the CPI is calculated in a closed room, under the inscrutable cover of green eyeshades. So that when the price of the 2022 Lego Guardians of the Galaxy Advent calendar you want to get for yourself your kids jumps up by $15 compared to similar block-sets, the headline rate may seem lower than what your lying eyes see. And we aren’t even touching on what’s known colloquially as “hidden inflation.” (If you need evidence of that concept, just look at the Reese’s Peanut Butter cup sizes over last Halloween versus the discs of gooey peanut butter we were treated as kids.)