Why You Should Care about a Freight-Rail Strike

We live in a country where the (currently) ruling political party and most of the national media have a symbiotic relationship. (Jen Psaki started work at NBC News this week.) One of the problems with this dynamic is that when the ruling class decides something is important — say, emphasizing the issue of abortion as the midterm elections approach — it tends to squeeze out everything that the ruling party doesn’t want emphasized.

Don’t get me wrong; abortion is a hugely important issue to many Americans. You can read more about the abortion bill South Carolina senator Lindsey Graham proposed yesterday from Alexandra DeSanctis and Charlie Cooke and John McCormack and Kathryn Jean Lopez.

But there are a lot of other things going on in this world, and one issue that seems spectacularly under-covered — a ticking time bomb, if you will — is that starting at 12:01 a.m. Friday, about a day and a half from now, if there isn’t a new labor deal between freight-rail unions and employers, the U.S. economy will be . . . derailed.

Maybe there will be an eleventh-hour deal; I suspect many casual observers simply assume that a deal will get done because the consequences of even a brief work stoppage would be so far-reaching. But freight companies are already halting certain shipments in preparation for a potential strike, so in some ways, the consequences of a strike are already here.

The American Association of Railroads said this week that it’s begun taking steps to secure the shipments of hazardous and security-sensitive materials, such as chlorine used to purify drinking water and chemicals used in fertilizer. It also warned that “other freight customers may also start to experience delayed or suspended service over the course of [this] week, as the railroads prepare for the possibility that current labor negotiations do not result in a resolution and are required to safely and securely reduce operations.”

At noon today, Norfolk Southern will close all gates to intermodal traffic — that means anything using multiple modes of transportation such as rail, ship, aircraft, and truck. BSNF Railway, one of the largest freight railroads in North America, stopped accepting intermodal traffic as of 12:01 a.m. this morning.

Amtrak has already suspended most cross-country routes and announced that, “It will only operate trains that can reach their final destination by 12:01 a.m. on Friday, when a freight rail strike or lockout could begin.” Without a deal, most Amtrak operations in California will be suspending operations starting on Thursday.

A freight-rail strike will also bring commuter-rail services to a halt in some areas: “Virginia Railway Express said if there is a strike it would immediately stop all of its commuter train service because Norfolk Southern owns the tracks for VRE’s Manassas Line, and CSX owns the tracks for its Fredericksburg Line.” Across the Potomac in Maryland, “Since CSX owns and maintains the Camden and Brunswick lines in addition to dispatching MARC trains, any labor strike would result in the immediate suspension of all MARC Camden and Brunswick Line service until a resolution is reached.” It’s the same story for Metra, the commuter-rail system serving the city of Chicago and its surrounding suburbs, and Metrolink, the commuter-rail service that serves southern California.

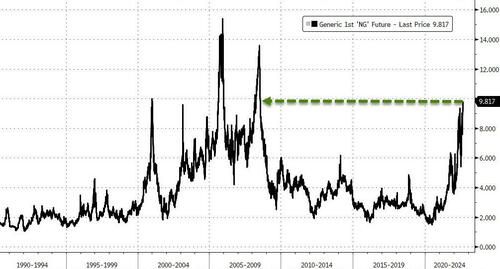

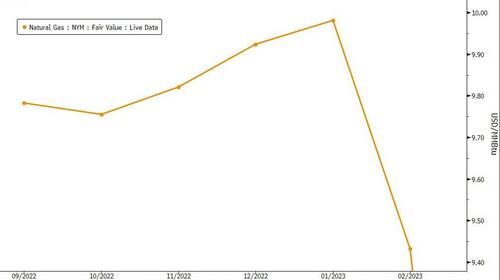

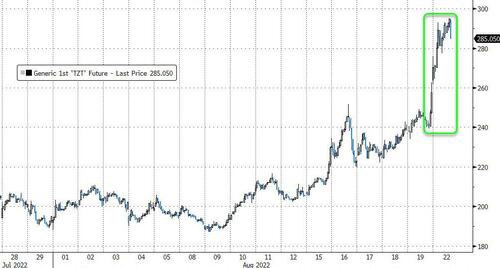

The U.S. Department of Transportation estimated that a freight-rail strike would cost the economy about $2 billion a day, but that’s just a big, abstract figure in most people’s minds. What Americans will notice is all kinds of products getting scarcer and more expensive (again). As our Dominic Pino notes, crude oil, natural-gas liquids, refined products, petrochemicals, and plastics are transported by rail, meaning that a disruption in freight-rail service is likely to spur a gas-price increase (again). The average price for a gallon of regular unleaded gas nationwide is currently $3.70, which is better than the $5 per gallon price of mid June, but it’s still high by historical standards.

Once again, if you read local press or trade publications, you realize how many things in this country grind to a halt if there’s a freight-rail strike. From EnergyWire:

Chemicals make up the second-largest category of rail freight after coal — 55,000 carloads a week — and there aren’t enough trucks and barges to handle the volume, said Jason Miller, a professor in the department of supply chain management at Michigan State University.

A prolonged strike would have a bigger impact on the economy than the shutdowns during the Covid-19 pandemic, Miller said.

“At least during Covid, you able to keep [chemical] production going, oil production going,” he said. “You can’t do that with a rail strike.”

Farmers have a limited window to get their harvested crops to buyers before the food spoils, and for many crops, this is harvest time; farmers are now wondering if the usual rail options will be available after Friday:

A painful example of supply chain concern can be found in soybean farming. Hungry markets in Asia and elsewhere count on soybeans to make the ships in the Gulf of Mexico and the west coast.

“It’s gonna be devastating because just about all of the soybeans that are produced here go to a crush plant, and that crush plant is in Hastings, and they send two unit trains of soybean meal per week to the Pacific Northwest,” Greving said. He sits on the USDA United Soybean Board. “That is loaded on bulk vessels there and shipped to Southeast Asia.”

The price of oil affects everybody, farmers included. A rail shutdown would also stop the delivery of corn to most ethanol plants.

Remember, many of the world’s food markets are still reeling from the effects of the Russian invasion of Ukraine and the near-complete shutdown of Ukraine’s food exports.

Yesterday, I briefly mentioned that a strike could disrupt the flow of coal to power plants. Grist lays out why there aren’t any realistic alternatives to get coal to those plants:

Because the fuel is so heavy and takes up so much space, rail is the only economical way to transport it from mines to power plants: The average coal train consists of 140 cars that each hold about as much coal as could fit on ten trucks. Even if coal could be shifted onto trucks, the trucking industry itself has also been experiencing labor shortages, and there’s not much excess truck capacity to absorb rail freight. . . .

“Coal stockpiles are already at historic lows in the United States,” said [John Ward, the executive director of the National Coal Transportation Association, a trade group representing coal shippers and buyers]. “Any further interruptions could be disastrous for power generation.

In the good old days, it wasn’t uncommon for utilities to have a 60- or 90-day supply of fuel, but I don’t know anybody who has that luxury now. If it became an extended strike, the consequences could be dire.” Should utilities burn through their stockpiles, they’ll have to slow down generation to save supply, which could lead to power shortages during times of peak demand. Prices would jump for as long as the supply backlog lasted.

The worst-affected places would be states like West Virginia and Missouri, which generate around 90 percent of their electricity from coal and don’t have the opportunity to switch to natural gas on short notice. Even states with large gas supplies will struggle, though, since gas markets are also tight as producers export large quantities of gas to Europe.

In case you’re wondering, no, trucks cannot pick up the slack. The American Trucking Association says it simply doesn’t have the spare trucks or manpower. “Idling all 7,000 long distance daily freight trains in the U.S. would require more than 460,000 additional long-haul trucks every day, which is not possible based on equipment availability and an existing shortage of 80,000 drivers,” ATA president and CEO Chris Spear wrote in a letter to Congress. “As such, any rail service disruption will create havoc in the supply chain and fuel inflationary pressures across the board.”

In other words, the strike scheduled to begin in, what, 36 to 40 hours after you read this, would be a far-reaching economic calamity.

And, in the eyes of some analysts, the country is in this spot because of the Biden administration’s decision-making, which aimed to maximize the leverage of its union allies:

“That this might occur right before the midterm elections is entirely self-inflicted by the Biden administration, where two of President Biden’s National Mediation Board [NMB] members took the bizarre step in June of terminating board-guided mediation two months early and starting the 90-day countdown to a possible rail strike,” Scribner told FOX Business, calling the move “unprecedented.”

If the NMB had stuck to the original schedule, Scribner says, the cooling-off period would have ended in mid-November. But instead, the board decided to cut things short.

If this was indeed some deliberate Biden administration strategy, you must wonder how well it thought this through, or whether the administration’s plan counted on a deal being reached by now. Because if there’s anything we know Joe Biden is loath to do, it’s suspending Amtrak service.

By the way, the potential railroad strike is mentioned in the 29th paragraph of today’s newsletter over at Politico. Today’s Axios newsletter does not mention the potential strike at all.

Pictured: WEF founder and executive chairman Klaus Schwab in Davos on May 23, 2022. (Photo by Fabrice Coffrini/AFP via Getty Images)

Pictured: WEF founder and executive chairman Klaus Schwab in Davos on May 23, 2022. (Photo by Fabrice Coffrini/AFP via Getty Images)