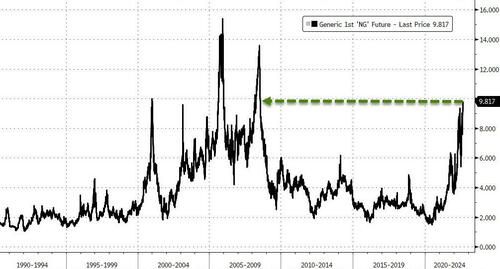

US NatGas Hits 14-Year-High, EU Benchmarks Explode Higher.

US natural gas futures surged to a new 14-year high this morning as European prices spiked on Russia’s move to shut a major pipeline (for “planned maintenance”), sparking increased fears that demand for American exports of the heating and power-plant fuel will soar when Freeport’s LNG Terminal comes back online in October.

Additionally, the next few months of the US NatGas curve are in contango with November 2022, December 2022, and January 2023 all traded above $10 this morning…

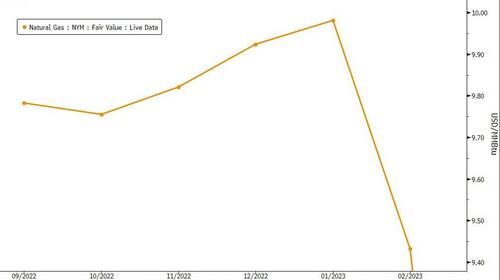

In Europe, benchmark gas futures rose as much as 20% to new record highs…

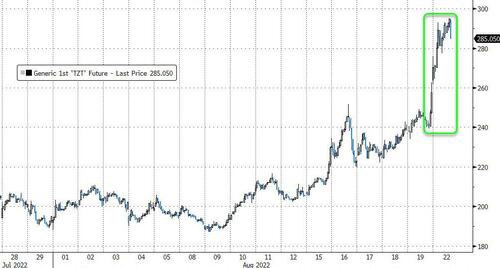

…driving electricity prices to fresh records, topping EUR700/mWh for the first time ever…

As Bloomberg reports, the key Nord Stream pipeline will stop for three days of maintenance on Aug. 31, again raising concerns that the conduit won’t restart as planned after the work.

“Whether the reasoning is true or not, the outcome drives a European gas market that tightens further, and one that is left reliant on demand curtailments to find itself in balance,” said Biraj Borkhataria, an analyst at RBC Capital Markets.

“The market may disregard Gazprom’s comments and start to consider whether the pipeline may not return to service, or at the very least may be delayed for any given reason.”

European authorities have repeatedly warned of the possibility of a total shutdown of Russia supplies as Moscow retaliates for sanctions imposed because of its invasion of Ukraine.

“The catastrophe is already there,” Thierry Bros, a professor in international energy at Sciences Po in Paris, said.

“I think the major question is when EU leaders are going to wake up.”

Finally, some context for what all this means.

EU NatGas is trading at an oil equivalent price of $500 per barrel and while EU NatGas is at 14 year highs (around $167 per barrel equiv), Europe’s cost is triple that!!

Both of which would suggest a very significant pressure for producers to transition from gas to crude as source. For now, oil prices are down on more Iran ‘deal’ headlines.