WHY TEAM BIDEN MIGHT BE PURPOSEFULLY GRINDING DOWN THE MIDDLE CLASS.

Now in handy video form!

Wondering why gas has nearly doubled since Biden took office? Watch this. pic.twitter.com/X5tcDOPtT8

— RNC Research (@RNCResearch) June 2, 2022

WHY TEAM BIDEN MIGHT BE PURPOSEFULLY GRINDING DOWN THE MIDDLE CLASS.

Now in handy video form!

Wondering why gas has nearly doubled since Biden took office? Watch this. pic.twitter.com/X5tcDOPtT8

— RNC Research (@RNCResearch) June 2, 2022

Democrat Senator Brags About How Gas Prices Don’t Affect Her

During Tuesday’s Senate Finance Committee hearing to discuss “The President’s Fiscal Year 2023 Budget,” Sen. Debbie Stabenow (D-MI) displayed just how tone-deaf she is on gas prices affecting her constituents when she bragged about driving an electric car. When it comes to the price at the pump, Sen. Stabenow said, “It didn’t matter how high [the price] was.”

“After waiting a long time to finally have enough chips in this country to finally get my electric vehicle, I got it and drove it from Michigan to here this last weekend and went by every single gas station, and it didn’t matter how high it was,” Sen. Stabenow said about gas prices. “And so I’m looking forward to the opportunity for us to move to vehicles that aren’t going to be dependent on the whims of the oil companies and the international markets,” she continued.

Biden Wants You to Know the Economy Is Super and if You Don’t Agree You’re a Moron.

In other words: The economy is doing great and if you can’t see that, you’re stupid.

Hasn’t he tried this strategy before?

Joe Biden has been tooting his own horn for over a year now by trying to take credit for the reopening of the economy after the lockdowns.

Phase one of this pivot was an op-ed in the Wall Street Journal with Joe Biden’s name in the byline (though was obviously written by someone else) claiming that the Biden administration’s “economic and vaccination plans helped achieve the most robust recovery in modern history.”

Biden’s new strategy comes on the heels of the latest economic report showing that the U.S. economic contraction in the first quarter of 2022 was even worse than expected. So, yeah… things really are going great, we’re just too stupid to notice. We’re too focused on gas prices and inflation to realize that everything is actually awesome.

Even Politico acknowledged that this strategy is likely to backfire. “Polling has shown that voters’ top concerns this year are the economy and inflation. Telling them that their day-to-day worries are not supported by macroeconomic data — or, as Biden writes, that ‘the U.S. is in a better economic position than almost any other country’ — is risky and could come across as tone-deaf, something frontline Democrats in swing districts have been concerned about.”

I think I can sum up Biden’s economic strategy in one video clip:

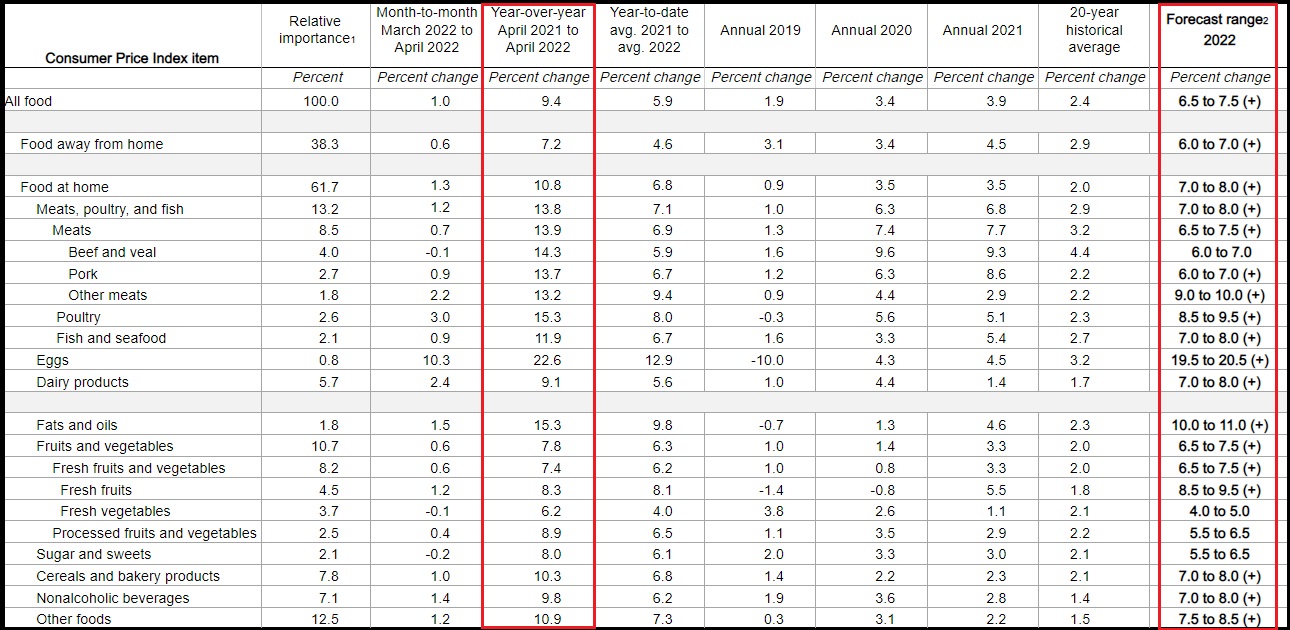

Have you ever seen egg prices at $1 per egg range, or $12/doz? Hold on a few months and perhaps you will. That is the context for the scale of food price increases the USDA is now starting to predict. The highest predicted change in food costs in well over 40 years, that’s the USDA warning in their revised May “Food Price Outlook”. [DATA HERE]

This month the USDA just re-re-revised the forward price outlook, and things are grim. It likely doesn’t come as a surprise to many CTH readers because we have been discussing the convergence of events since October of 2021, when we first were able to predict Wave-1 (Dec/Jan), and Wave-2 (March/Apr) inflation. However, the underlying data for Wave-3 is double the prior two phases.

Keep in mind the data is national & skewed toward low estimations as represented by (+).

When the USDA predicts egg prices increasing by 19.5 to 20.5% (from where those prices are now), there will be regions with much higher retail increases than estimated.

Just two months ago, USDA had egg inflation at 2.5%-3.5% range, year over year. Again, that’s the scale of change; from a 3.5% forward outlook to a 20.5% forward outlook effective right now.

Food at home (grocery store) prices: up 7% to 8% in this monthly review, versus the April outlook of a rise of 5% to 6%. That means the USDA is predicting the highest grocery store price rise since 1980 when prices rose 8.1% (prices rose 7.2% in 1981). There is no reason to think the USDA forecast will not rise again in June.

[Click graphic to expand – Data Set Here]

If you have not taken food price stability seriously before now, please take proactive measures to secure your family. We are talking about future retail food prices that were simply unfathomable last year.

You know how much prices at the supermarket have increased in the last six months. Double that, and there’s your estimation for food prices later this fall.

Behind all the datasets, statistics, BEA, BLS, USDA and analysis of these things, there are real people living paycheck-to-paycheck that are likely to be in serious food insecurity position for the first time in their lives.

I’m not talking about poor people, I’m talking about solid upper middle-class working families with kids who are already being hit hard by gasoline, energy, housing and grocery store increases. Another twenty percent increase in food costs can easily become a crisis.

The core issue is this snowball of production costs inside the field to fork supply chain. Diesel prices, fertilizer prices, energy prices, seed and feed prices, all of it has doubled and tripled in less than a year.

Add in transportation and distribution costs that have doubled, and all of that cumulative impact is going to flow through the food supply chain from the field to the processor (wholesaler), and into the supermarket. Fresh foods, especially in the produce section, will catch many people off guard.

Not all news associated with this is bad news. As you read this you have information that allows you to take control and be proactive. YOU will not be part of the national population that is stunned in September and October. YOU know what is coming. With that in mind, do what you can today, tomorrow, this week, to be proactive and offset the impact. Taking action reduces stress.

Perhaps shop proactively for your holiday shelf stable food items now. Look at the circulars and on-line for coupons, not for then – but for use now. Perhaps learn to make some of the foods you would normally purchase already prepared. Small proactive seeds, kept in mind while carrying on day-to-day life.

I know from reading comments that many of you have planted ‘victory gardens’ this year. Those harvests are worth 50% more now they were three months ago. That’s the way to look at it. Every amount of saving matters…. and yes, grandma carefully washed the aluminum foil and reused it for a reason.

My theological differences with them aside, the Mormon’s doctrine of a family having a huge supply of food stocked is not a bad idea.

Jim Taylor can relate to you what happened when the Mozambique goobermint had to raise the price of staple foods. When people barely make enough money to live from day to day, a rise in price can mean starving. We’re not Mozambique, but we’ve got a lot of people living from one paycheck to the next.

BLUF

My best guess is we will see some more price increases in food-especially products that have wheat in them. It might be a good idea to buy a side of beef or pork for a home freezer. I don’t think we will run out of food. We might run out of variety, and it will be more expensive but the drivers of prices increases look to be fuel costs and interest rate costs.

We know that Ukraine is the breadbasket for a lot of Europe and Russia. The “War of Russian Aggression” has totally disrupted the supply chain. It’s not just wheat, but things like nitrogen and urea.

I have been looking for some good data on food. Frankly, I have seen my grocery bill go up quite a bit and I am trying to figure out if I should stockpile foodstuffs or not.

It is a La Nina year. That brings a lot of dryness to places like South America. Unscientifically, everyone I know in Las Vegas says it has been a lot windier here than normal. Expect more hurricanes this year in the southeast. Hint: It’s not global warming.

If it looks, walks and quacks like a duck………….

BLUF

So does the Biden administration actually want to see middle-class Americans reduced to poverty and privation? Or is it just too stupid to foresee the obvious consequences of its own action? At this point, I’m not even sure which is worse.

But with the midterms coming, no amount of talk about gun control, abortion or other Democratic hot-button issues is going to distract Americans from what’s happening to their pocketbooks. Good.

Team Biden might be purposefully grinding down the middle class.

Vladimir Lenin supposedly once said, “The way to crush the bourgeoisie is to grind them between the millstones of taxation and inflation.”

There’s some doubt as to whether this line is genuine; regardless, it seems like a pretty good description of what the Biden administration is doing to America’s middle class.

Inflation is running rampant. The Producer Price Index, the most useful measure of general inflation, is up a whopping 16.3% from April 2021, per the Bureau of Labor Statistics.

That means that roughly $1 out of every $6 that people earn has been lost to inflation in a single year. Or to put it another way, 80 minutes’ earnings out of every eight-hour day have been eaten up.

This is predictable, of course. Team Biden took an already-bloated federal budget and supersized it with spending last year, printing money hand-over-fist to fund a massive array of pork-filled programs, many if not most of which guided billions of dollars into the pockets of Democratic Party supporters.

President Joe Biden dismissed inflation worries at the time, saying that Milton Friedman — the famed inflation-fighting economist — no longer runs the show. Well, the late economist certainly didn’t run Biden’s show, but his observation that inflation is always and everywhere a monetary phenomenon was borne out in spades as prices took off.

And it was a double whammy. Inflation comes when you have too much money chasing too few goods. The spending part provided the excess money, but the Biden team was right there helping to ensure fewer goods, too.

Gas prices going up? Not only was Biden’s spending program stimulating inflation, but at the same time Biden policies were reducing the amount of gasoline, diesel and heating oil those dollars could buy. Biden went wild canceling pipelines, ending gas and oil leases, imposing stricter environmental rules and — in cooperation with big institutional investors — choking off the finances of people trying to produce new fuel supplies.

As Sen. Dan Sullivan (R-Alaska) observed, “There has been a comprehensive hostility to the energy sector by this administration.” And how.

What about jets? pic.twitter.com/4PubXEQcA9

— Şahsıma münhasır (@aikitango2) May 24, 2022

Democrats’ Latest Phony Inflation Scapegoat: Credit Cards

In this administration, it’s always someone else’s fault. Inflation is now the No. 1 concern of voters, so the White House first blamed COVID. Then Donald Trump’s tax cuts. Then Vladimir Putin. Then meatpackers and the poultry industry, Big Oil and pharmaceutical companies.

Now, Democrats have identified a new inflation scapegoat: plastic. Visa, Mastercard, American Express and other credit cards hidden away in your wallet.

Sen. Dick Durbin (D-Illinois) has had it out for credit cards for almost two decades, even though over that period, credit cards, which were once reserved for the rich, are now nearly ubiquitous in our society. Many stores don’t even take cash anymore in the post-COVID world. The benefits and conveniences of paying with a plastic card are easily in the tens of billions of dollars to retailers and shoppers. Stores benefit because shoppers don’t have to have cash on hand to make purchases. They also benefit from not having to deal with the exchange of cash, which can lead to theft by unscrupulous employees at the register.

Credit cards are convenient for consumers because we don’t have to walk around with hundreds of dollars in our wallets.

But Democrats allege that the interchange fee that credit card companies charge retailers and merchants for their service on transactions is excessive. This interchange fee typically ranges between about 1% to 3% of the retail price of the transaction. If retailers don’t want to pay the cost because they think it is exorbitant, they don’t have to accept cards and can take cash only. Few retailers don’t take plastic every day to avoid paying the fees. It’s a free country. But the vast majority of retailers see the benefits far exceeding the costs.

Durbin, a member of the Senate Judiciary Committee, doesn’t see it that way. Instead, he blames Visa, Mastercard and Discover for making food and gas more expensive. At a recent hearing, Durbin fumed: “Today, we’re going to talk about a hidden fee that fuels the fires of inflation across America every day. What they may not know is this swipe fee is contributing to the problem of inflation.”

But for this to be true, interchange fees would have to be higher than before Joe Biden became president and before inflation surged to 8.5%.

But the fees aren’t rising. Industry sources report that over recent years, the average merchant fee (for debit, credit and prepaid cards) has fallen slightly.

By the way, merchants and retailers get concrete benefits in exchange for the fees they pay to accept credit cards. Those fees cover the cost of security and fraud protection, infrastructure improvements and consumer benefits programs such as cash back and rewards.

What Durbin and the Democrats want is government price controls on credit card companies. They say there isn’t enough competition, but there are at least five major credit cards the public can buy. There is plenty of competition in the industry. Nor is there any evidence that cutting the fees to the retailers will lead to lower prices paid by consumers at the gas pump or the grocery store checkout line.

Today, about 70% of retail transactions take place with credit cards in part because nearly everyone, except those with terrible credit histories, has a credit card these days. Projections say in the next decade, more than 80% of payments will be made with plastic as we move inevitably to digital transactions and a cashless society.

The significant impact of Durbin’s price controls will not be to tame inflation but to restrict who can get access to credit cards. In other words, the poor will get hurt the most. Isn’t that turning out to be the case with nearly every liberal policy these days?

World has 10-week supply of wheat, expert tells UN Security Council,‘This is seismic.’

NEW YORK – Global food insecurity has reached levels not seen since the financial crisis of 2008, and it’s only going to get worse without aggressive intervention, a food insecurity expert told the United Nations Security Council this week.

Russia’s invasion of Ukraine “did not start a food security crisis,” but it did add “fuel to a fire that was long burning,” said Sara Menker, CEO of Gro Intelligence, a global company that uses artificial intelligence and public and private data to predict food supply trends.

“This isn’t cyclical. This is seismic,” Menker said during a special meeting of the UN Security Council. “Even if the war were to end tomorrow, our food security problem isn’t going away anytime soon without concerted action.”

Before the Russia-Ukraine conflict began, the two countries supplied a combined one third of the world’s wheat exports and were in the top five exporters of corn. Coupled with widespread fertilizer shortages, supply chain issues and record droughts, the world has about 10 weeks worth of wheat on hand, Menker said.

“Without aggressive global actions, we stand the risk of an extraordinary amount of human suffering and economic damage,” Menker said.

We hope they can get the crops to harvest and then to the consumer.

Ukraine sows crops on over 80% of planned lands.

KYIV. May 20 (Interfax-Ukraine) – Ukraine has sown crops on 11.84 million hectares, or 82.2% of the 14.4-million-hectare area planned for this spring, including crops sown on 1,94 million hectares on May 12-19, the Ukrainian Ministry of Agrarian Policy and Food said on Friday.

Sunflower crops have been sown on 3.94 million hectares (80% of the 4.93 million hectares planned for 2022), corn on 4.17 million hectares (86% of 4.85 million hectares), spring barley on 927,500 hectares (92.6% of 1.02 million hectares), spring wheat on 188,600 hectares (99.4% of 189,600 hectares), oats on 156,800 hectares (95.8% of 163,600 hectares), and peas on 124,800 hectares (86% of 145,700 hectares) as of May 19, according to a statement published on the ministry website.

In addition, the areas sown with potatoes stand at 1.07 million hectares (90% of 1.19 million hectares), while soybeans are sown on 728,600 hectares (78.6% of 1.25 million hectares), sugar beet on 182,000 hectares (88% of 206,900 hectares), spring rapeseed on 28,400 hectares (95.3% of 29,800 hectares), millet on 32,100 hectares (51.5% of 62,300 hectares) and buckwheat on 37.400 hectares (46% of 81,600 hectares).

“The sowing is continuing in Ukraine. Spring wheat has been sown on almost 98% of the planned area,” the ministry said.

Winter crops were sown on 7.7 million hectares in 2021, including 6.5 million hectares of wheat, one million hectares of barley, and 0.16 million hectares of rye.

As reported earlier, Ukraine will reduce the sowing of highly marginal crops (sunflower and corn) this year, while increasing the area under simpler crops that are more important for food security – peas, barley and oat.

Ukrainian Prime Minister Denys Shmyhal said on April 20 that Ukraine would sow crops on approximately 14.2 million hectares this year, which is 80% of 16.9 million hectares sown with crops last year.

Earlier, the Ministry of Agrarian Policy and Food estimated the spring 2022 sowing at 13.44 million hectares, as against 16.92 million hectares in 2021.

Deputy chief of staff of the Ukrainian presidential office Rostyslav Shurma said that Ukraine was aiming at a 2022 harvest of at least 70% of the previous amounts.

Well, he’s always been known as a liar

I know gas prices are painful. My plan will help ease that pain today and safeguard against it tomorrow.

I'll continue to use every tool at my disposal to protect you from Putin’s price hike. And I’m calling on Congress to put aside partisanship. Let’s meet this moment together.

— President Biden (@POTUS) April 1, 2022

The Biden administration has canceled one of the most high-profile oil and gas lease opportunities pending before the Interior Department. The decision comes at a challenging political moment when gas prices are hitting painful new highs. https://t.co/9WzYVxEPYX

— CBS News (@CBSNews) May 12, 2022

Observation O’ The Day

YEP, THAT’S BIDEN’S STAGFLATION THAT JUST ARRIVED:

That 1.4 percent contraction in the economy in the first quarter of 2022 represents the first statistical evidence that we’re entering a period of roaring inflation and stagnate growth.

“The trade deficit ballooned massively, due to mushrooming imports. American exports fell by 9.6 percent, while imports went up by 17.7 percent. Economists had predicted a 1 percent economic growth rate, rather than the decline in the economy that actually occurred,” reports Liberty Unyielding’s Hans Bader.

And the cause is clear, according to Bader, who says “the economy is being held back by Biden administration policies that discourage work, reward idleness, and make it harder for companies to attract employees. Biden enacted policies that reduced the size of America’s private-sector workforce and made America less economically competitive.”

It’s almost like it’s a plan.

BLUF:

If the Biden administration wanted to fight stagflation, it would be cutting red tape, encouraging business activity and investment and slashing federal spending. But it’s not doing that.

Why not?

Stagflation is staring Biden in the face — but he refuses to change course.

First we were told inflation was imaginary. Then we were told it was “transitory,” the result of COVID-inflicted supply-chain problems. Then we were told it was Russian President Vladimir Putin’s fault.

Now people are starting to admit the massive runaway spending of the Biden era has something to do with it. But we’re also facing stagflation, a mixture of inflation and slow growth, and the government also plays a role in turning inflation into stagflation.

As Milton Friedman famously warned, inflation is always and everywhere a monetary phenomenon. When the government pumps the economy up with excess dollars — something usually referred to as “printing money,” though a too-literal USA Today fact-checker hastened to assure us that much of the money created isn’t actually printed on paper — inflation results. When you have more money in the system than goods, the price of goods goes up. That’s inflation, and it’s what’s happening now.

We’re seeing it everywhere, from soaring food and gasoline costs to a housing “bubble” that looks more like inflationary pricing to increases in rents and automobile prices and just about everything else. The latest figures, meanwhile, show that the economy shrank 1.4% last quarter, making it the worst since the pandemic’s start; economists had expected 1.1% growth.

There are two ways to address inflation: Remove some of the money from the system, which the Federal Reserve did in the past via higher interest rates, and increase the supply of goods. At this point in 1980, when inflation soared, the federal funds rate was nearly 20%. Presently, it’s 0.33%.

In the Carter era, we saw not only runaway inflation but stagflation. People normally associate inflation with an overheated economy, but the sluggish Carter economy was not even close to running hot. We had economic stagnation and inflation, which led to the coinage of the term “stagflation.”

Now we’re seeing the same thing. And I suspect the reason is the same.

Scholars of administrative law refer to the 1970s as a period of “regulatory explosion.” The inflationary spiral was driven by the massive increase in spending under Democratic President Lyndon Johnson. But when Republican Richard Nixon came in, he didn’t do enough to restrain spending. Worse yet, he midwifed the greatest expansion of federal regulatory authority since the New Deal. In fact, in many ways the regulation was more intrusive and pervasive.

Inflation Hits Annualized Rate of 16.8%: Gas is up 52%.

u.s. annual price changes in march 2022

fuel oil +70%

gas +48%

used cars/trucks +35%

airline fares +24%

meats/poultry/fish/eggs +14%

electricity +11%

dairy +7%

apparel +6.8%

rent of primary residence +4.4%-bls

— ian bremmer (@ianbremmer) April 13, 2022

Yesterday, Joe Biden went to Iowa and pandered to corn growers. He is lifting an EPA restriction on the amount of ethanol a gallon of gas can contain. People who follow the fuel industry and understand the engineering around producing fuel know that ethanol is a terrible additive to fuel. It decreases gas mileage. It’s not as efficient as gas.

Remember, Biden is doing this when farmers are going to pay significantly more for fertilizer because of his administration’s missteps in Ukraine leading to Putin’s invasion.

Biden’s actions yesterday just increased corn prices ($ZC_F).

20 Facts About the Emerging Global Food Shortage That Should Chill You to the Core

A very alarming global food shortage has already begun, and it is only going to get worse in the months ahead. I realize that this is not good news, but I would encourage you to share the information in this article with everyone that you can. People deserve to understand what is happening, and they deserve an opportunity to get prepared. The pace at which things are changing around the globe right now is absolutely breathtaking, but most people assume that life will just continue to carry on as it normally does. Unfortunately, the truth is that a very real planetary emergency is developing right in front of our eyes. The following are 20 facts about the emerging global food shortage that should chill you to the core…

Biden is clueless about inflation ‘FIFY

Comment O’ The Day

We now have the answer to how quickly can electing (installing) the wrong person (and party) as President destroy a country.

The answer: About one day.

Biden started his destructive policies on day one by issuing several executive orders and everything he has done since then has just added to the problem.

What happened to the U.S. having an export surplus?

SloJoe, that’s what happened

OPEC refuses to increase oil output as US announces massive release of crude reserves.

OPEC and its allies including Russia decided on Thursday to stick with a schedule of gradual production increases as the U.S. weighs an unprecedented release from its national strategic petroleum reserves in an attempt to bring down gasoline prices.

The group, known as OPEC+, said Thursday that it would boost crude output by 432,000 barrels a day in May as it works to restore pre-pandemic levels of production, according to a statement. That’s up slightly from 400,000 barrels per day in previous months.

The oil-producing nations have resisted pressure from the U.S. to pump more crude as prices soar, exacerbating already sky-high inflation. The high prices have also helped Russia to offset the pain of Western sanctions imposed over its invasion of Ukraine last month.

The move came as President Biden on Thursday morning ordered a record-setting 180 million barrels of oil released from the nation’s Strategic Petroleum Reserve in hopes of lowering gas prices. If fully enacted, the president’s plan would release 1 million barrels per day for the next 180 days.

Established after a 1973-74 oil embargo by Arab members of OPEC, the reserve has been used in several emergencies, including in 2005 after Hurricane Katrina made landfall and destroyed swaths of the Gulf of Mexico oil infrastructure. At the time, the Bush administration authorized the release of 20.8 million barrels of crude oil to U.S. producers.

Proponents of releasing barrels from the emergency stockpile say that doing so would increase oil supplies and reduce prices at the pump, while also generating billions in revenue for the federal government. Still, critics say that releasing emergency supplies is a short-term fix to a problem and does not actually increase the country’s oil-production capabilities.

The soaring oil prices have roots in the faster-than-expected economic recovery from the pandemic, which has triggered the hottest inflation in decades amid strong consumer demand, an influx of government stimulus and disruptions in the global supply chain. But in recent weeks, the war between Russia and Ukraine has sent global prices even higher as it impedes the world’s access to energy supplies.

The average price for a gallon of gas was at $4.22 nationwide Thursday, according to AAA, up from $2.87 one year ago but down slightly from last week’s level. In California, prices are as high as $6 a gallon. Until this month, prices had not topped $4 a gallon nationally since 2008.

Key Fed inflation gauge jumps 5.4% in February, biggest gain since 1983.

Core prices, which exclude the more volatile measurements of food and energy, soared by 5.4% in the year through February, according to the personal consumption expenditures price index data released Friday morning. That measurement is the Fed’s preferred gauge to track inflation; it marks the 11th consecutive month the measure has been above the central bank’s target range of 2%…………….

Still very low, but when it was in the “2s”……..

Mortgage rate soars closer to 5% in its second huge jump this week.

The average rate on the 30-year fixed mortgage shot significantly higher Friday, rising 24 basis points to 4.95%, according to Mortgage News Daily. It is now 164 basis points higher than it was one year ago.

On Tuesday, the rate had hit 4.72%, a 26-basis-point jump from March 18. The quicker-than-expected rise in rates has weighed on demand for mortgages and refinancing loans.

The rate surged as the yield on the U.S. 10-year Treasury also took off. Mortgage rates follow that yield loosely, but not entirely. Mortgage rates are also influenced by demand for mortgage-backed bonds. The Federal Reserve is scaling back its holdings of these assets and is also hiking interest rates.

It couldn’t come at a worse time, as the all-important spring housing market gets underway. Potential buyers are already facing extraordinarily tight supply and sky-high prices. With both rates and prices considerably higher, the median mortgage payment is now more than 20% higher than it was a year ago.

Buyers are also facing inflation on everything else in their budgets, which exacerbates the affordability issues. Rents are also surging higher at a record rate, causing more potential buyers to be unable to put aside money for a down payment. In addition, as rates rise, some buyers will no longer qualify for a mortgage. Lenders have been much more strict about how much debt a borrower may take on in relation to income.

NAR’s latest official prediction is for sales to drop 3% in 2022, but Yun now says he expects they will fall 6% to 8%. NAR has not officially updated its forecast.

Consumer Sentiment Sinks as Hope Crashes and Inflation Expectations Hit Four-Decade High

Everyone has jobs and no one is happy because prices are rising so sharply.

U.S. consumer sentiment fell in March to the lowest since 2011 despite the level of jobless claims declining to the lowest level in decades and unemployment likely sinking to multi-decade lows.

The University of Michigan’s sentiment index dropped to 59.4, from 62.8 in February, data released Friday showed. This was lower than the mid-month read of 59.7. Economists had projected no further deterioration from the mid-month reading.

“Inflation has been the primary cause of rising pessimism, with an expected year-ahead inflation rate at 5.4 percent, the highest since November 1981,” said Richard Curtin, the surveys chief economist, in a statement.

The sentiment index has taken a severe beating in the first year of Biden’s presidency, falling 30 percent compared with March of 2020. The index of current conditions is off by 27.7 percent while the expectations index is down 31.9 percent.

I mean, what’s the point of being a ruling class if you can’t lord it over the plebs? /sarc

Observation O’ The Day

“From Veblen to Galbraith, what has distressed the American critics of the free economy is not private property – which is the cornerstone of their own independence – but the private property of others.

In recent times it is the spectacle of property in the hands of ordinary, gross, uneducated people that has troubled the domestic critics of American capitalism.”

— Roger Scruton