Think you food prices are high now? Just wait.

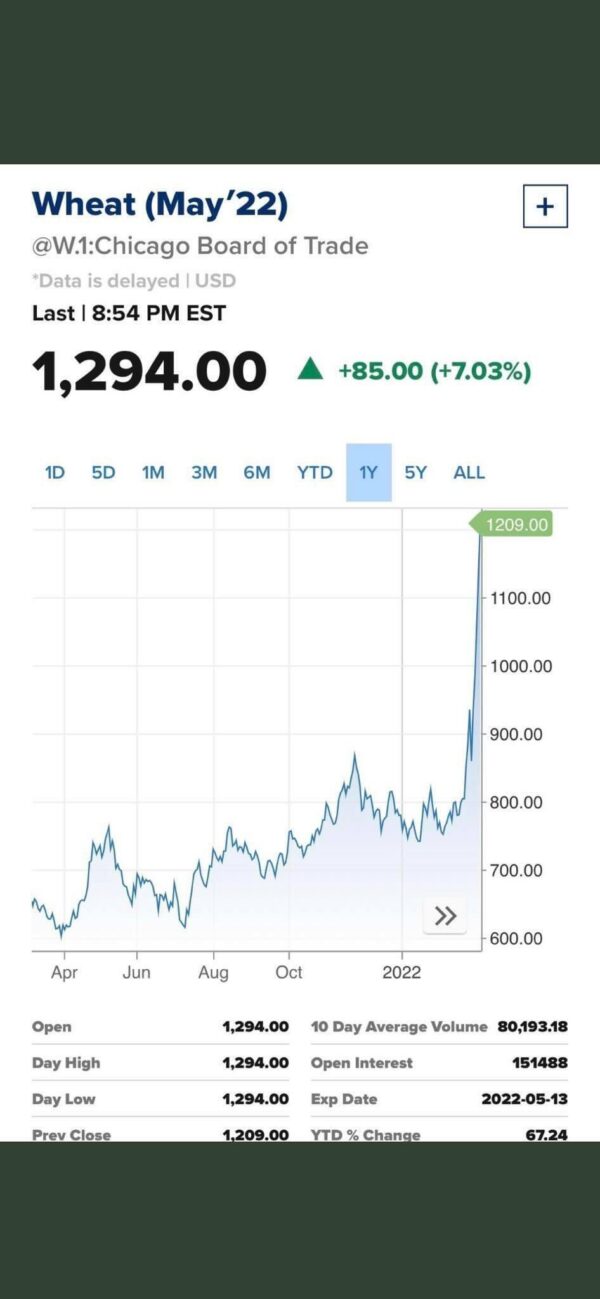

U.S. wheat futures have climbed past record highs set in 2008, with fears about the absence of Russian or Ukrainian wheat from the world export market driving them higher today.

The continuous wheat contract on the Chicago Board of Trade is up 7% to $12.94 per bushel Monday. The increase again hit the exchange’s limit for how much the price could move in a day. It comes after wheat posted an uptick of more than 40% in the past week—breaking a record set in 1975.

Helping accelerate wheat’s uptick, grain traders say, is a sizable squeeze in short positions that were held before the war in Ukraine began.

“The short squeeze in wheat has been breathtaking as the world lost 30% of its export capacity due to Russia’s war on Ukraine and closure of Black Sea supplies,” agricultural research firm AgResource said. “Importers will draw down their own domestic stocks and scour the world for additional supply for April/May.”

Russia was the world’s leading exporter of wheat in the last full marketing year ended June 2021, according to data from the U.S. Department of Agriculture. In that marketing year, Russia exported 39.1 million metric tons of wheat.

Other grain futures have been on the rise since the fighting in Ukraine began. Corn futures on the CBOT traded at over $7.56 per bushel in premarket trading Monday, the highest they have been since December 2012. Meanwhile, soybeans were at $16.67 per bushel premarket, down slightly from a high set earlier this month. Before that, soybeans hadn’t traded that high since September 2012.

The war in Ukraine has lifted already rising commodities prices, drawing additional attention to consumer prices already affected by inflation caused by demand and snarled supply chains.