For his opening monologue and first interview tonight, Fox News host Tucker Carlson outlined the ramification of non-western nations now trading in alternative currencies to the U.S. dollar. As the dollar diminishes in value, and as an outcome of Biden using U.S. treasury bonds as part of the sanction regime against Russia, various non-western nations now perceive holding dollars as exposing themselves to risk.

Carlson is joined by Luke Gromen who accurately notes the dollar as a global trade currency may continue, but foreign nations holding U.S. treasury bonds as an asset will likely start contracting. The result of U.S. treasury bonds returning after maturity with no repurchase, would be an inability of the U.S. to borrow against their sale. This could, perhaps likely will, severely diminish the amount of money the U.S. congress can spend.

None of this should come as a surprise to those who have paid attention. Factually, in March of last year, one month after the Russian sanctions were announced, the International Monetary Fund’s (IMF) Deputy Managing Director said the sanctions against Russia are likely to undermine the US dollar’s global dominance as a trade currency. Everyone could see this coming.

(Inside Paper) – March 2022 – […] “The dollar would remain the major global currency even in that landscape, but fragmentation at a smaller level is certainly quite possible,” Gopinath said in an interview with the Financial Times. She went on to say that some countries have already begun to renegotiate the currency in which they are paid for trade.

According to Gopinath, the drastic restrictions imposed by Western countries in response to Russia’s military operation in Ukraine may result in the formation of small currency blocs based on trade between individual groups of countries. Furthermore, the use of currencies other than the dollar or the euro in global trade would result in a further diversification of central banks’ reserve assets. (read more)

The efforts of NATO and the western alliance to crush the Russian currency have failed. The Russian ruble currency has jumped back from the sanctions and is now even stronger than before the sanctions were put into place.

With China and India supporting ongoing trade with Russia, and with Saudi Arabia responding coldly to the U.S. working on a deal with Iran for nuclear weapons, the geopolitical strategy of NATO, G7 and the proverbial western alliance increasingly looks like it will backfire.

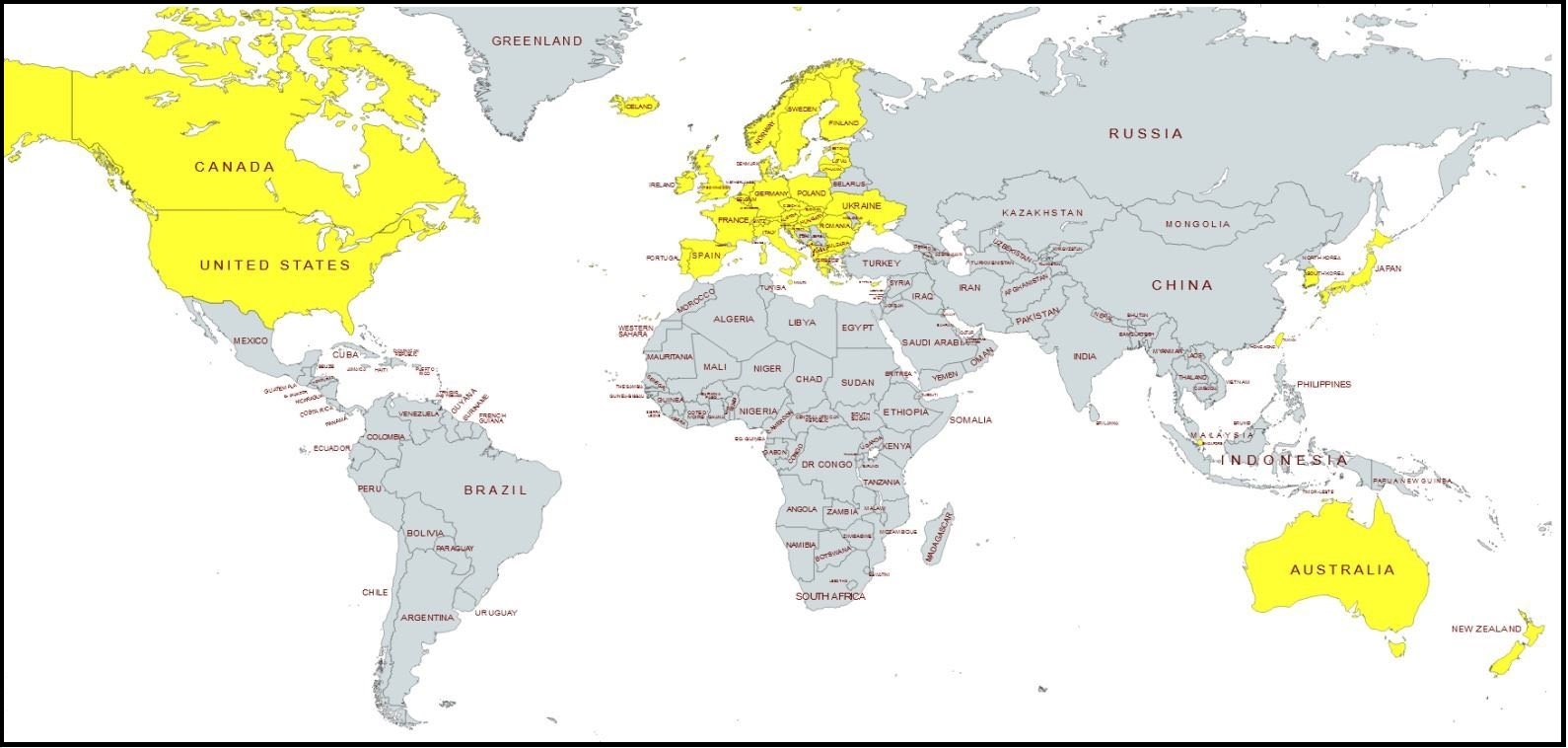

Yellow Team -vs- Gray Team: Remember, China just brokered a deal to lessen hostilities between Iran and Saudi Arabia. The fulcrum of that agreement was economics.

Meanwhile in North America, Mexican President Andres Manuel Lopez-Obrador has said he was not willing to join the energy suicide pact pushed by Joe Biden and Justin Trudeau…. A policy break in the trilateral relationship which suddenly, and not coincidentally, aligns with the timing to make Mexico a pariah to the U.S. vis-a-vis a renewed media push on the drug cartel narrative.

BIG PICTURE NOT BEING DISCUSSED – The western politicians followed the climate change instructions of the WEF multinational corporations and banks (Build Back Better) and post-pandemic immediately started reducing energy development. The central bankers then began raising interest rates to shrink the economies of the same western nations to the scale of the now diminished energy production.

The raising of interest rates is now hitting the national and multinational banks impacted by government policy that was following WEF orders. Now the western politicians are stepping in with the government controlled central banks to backstop the national banks and multinationals. Can you see the dynamic?

Team yellow is suffering the consequences of their own ideological policy as enacted. Team grey is not going to help team yellow get out of a crisis team yellow created, which was intended to hurt team grey.

…. And we continue watching.